This guide presents practical strategies for managing Australia's rising living costs in 2025. With core inflation at 2.8-3.2%, down from 4.1% in late 2024, Australians can take advantage of several key opportunities to reduce expenses.

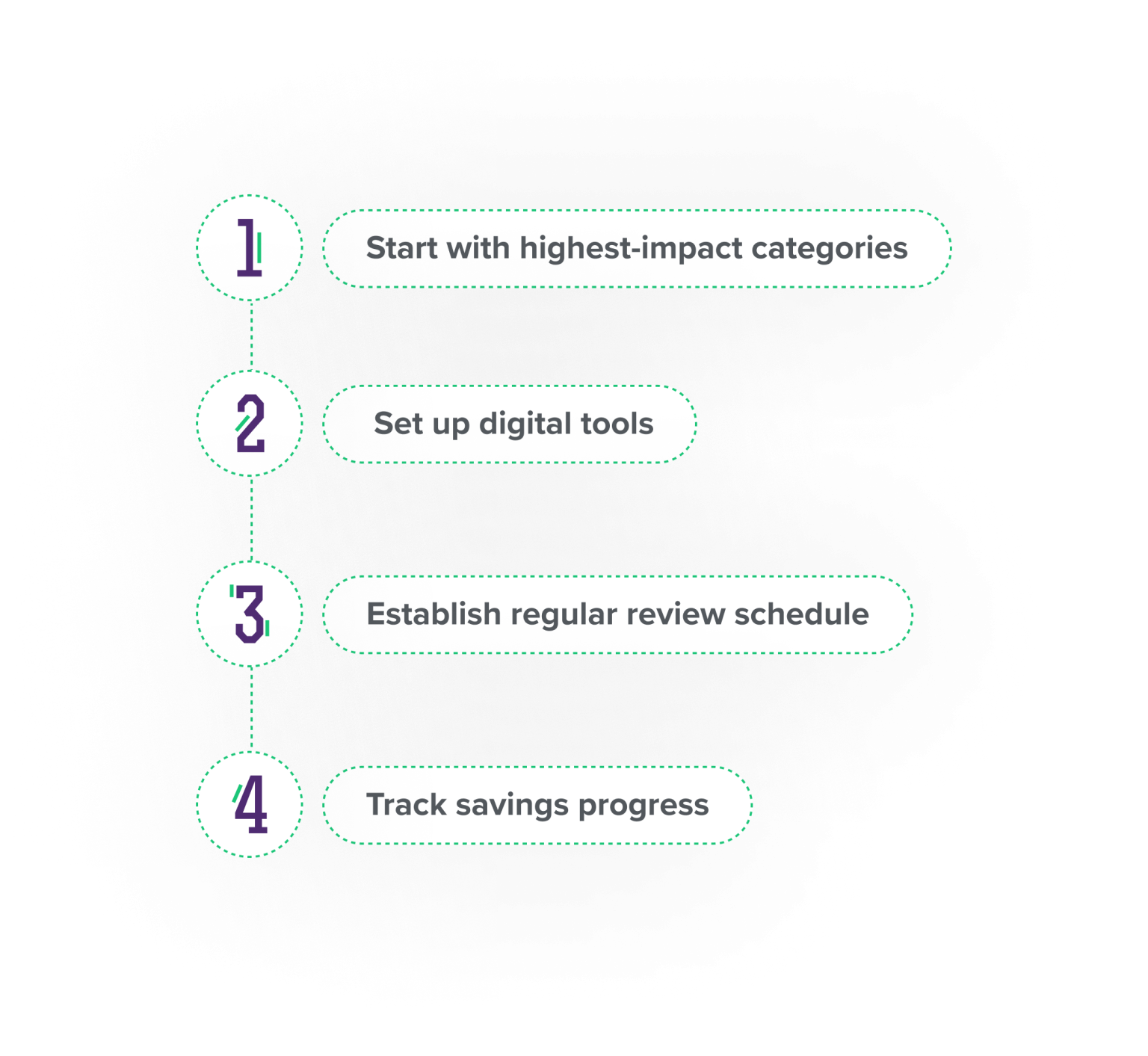

This guide provides a structured approach focusing on high-impact categories first, followed by systematic implementation of digital tools and regular review of savings progress. These strategies are designed to be practical and achievable while maintaining quality of life, with specific focus on Australia's unique market conditions and opportunities.