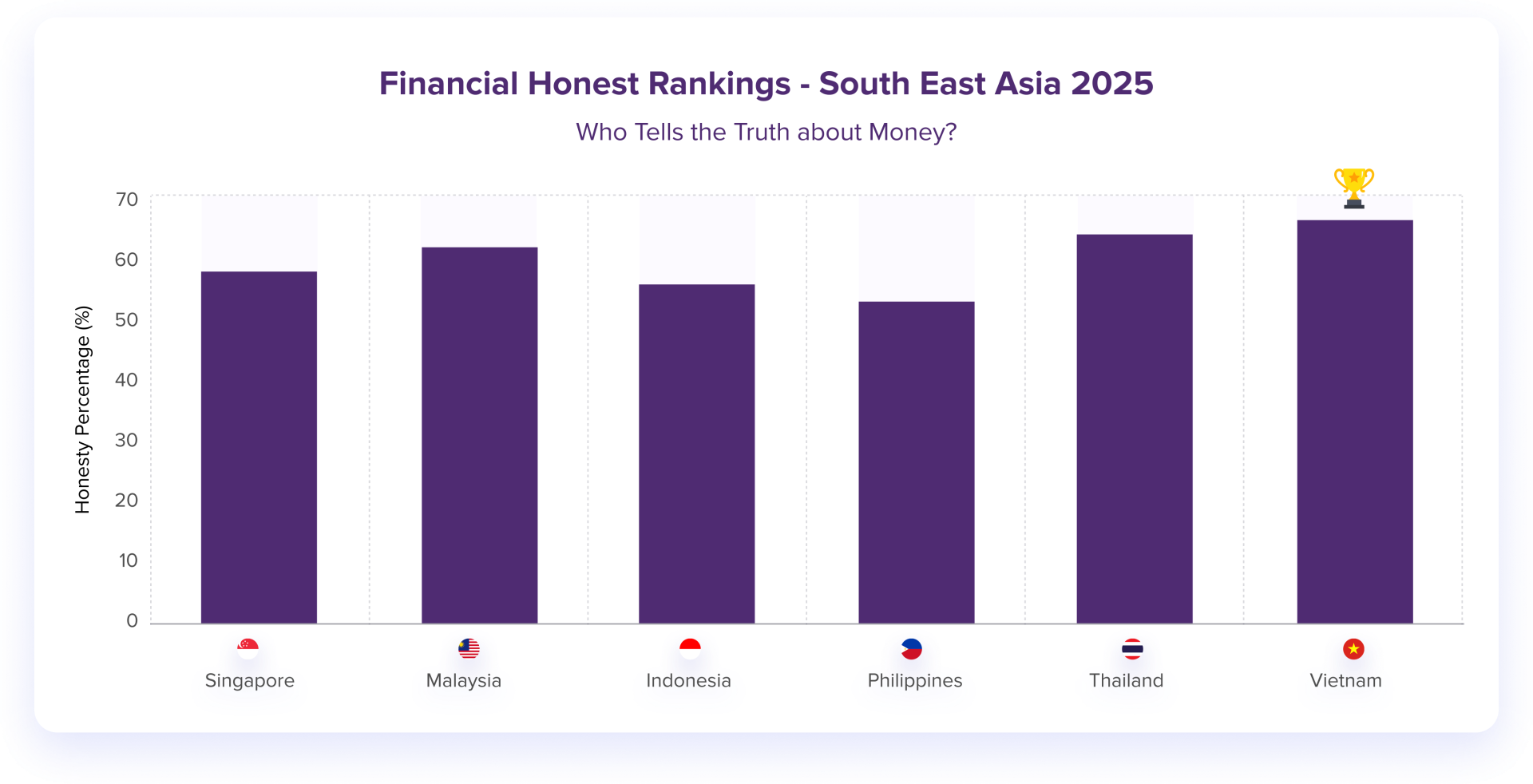

Vietnam stands out as Southeast Asia’s most financially honest country, with 66% of people sharing accurate information about their finances. This stems from cultural values rooted in trust and community accountability combined with socioeconomic conditions that reduce the need for people to misrepresent their financial situation to survive or compete.

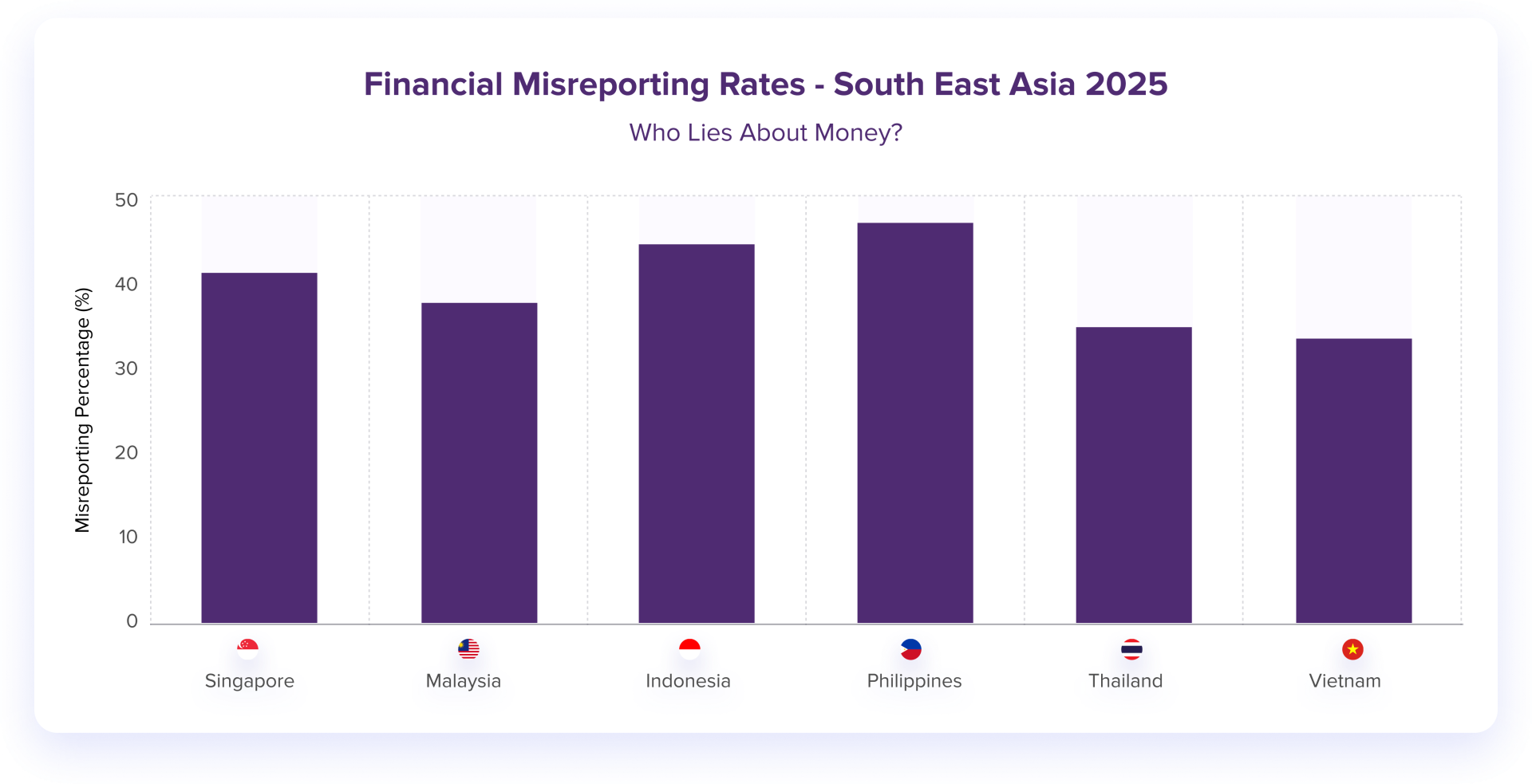

The Philippines reports the highest level of financial misreporting at 47%, reflecting the combined effects of economic stress, face-saving cultural norms and limited financial education. Indonesia shows a similar trend at 45%, driven by the same pressures where economic challenges intersect with cultural expectations to preserve social harmony and status.

Although Singapore enjoys high average monthly incomes of S$6,167, 41% of respondents still misreport their finances due to the nation’s intensely competitive culture. In a society where people compete for top housing, schools and opportunities, financial honesty can become a disadvantage. Singaporeans often adjust how they present their finances not out of desperation but from fear of losing ground in a highly competitive environment.

Across Southeast Asia, people's willingness to be honest about their finances varies dramatically. Our study reveals clear patterns: some countries have built cultures that naturally encourage financial transparency, while others face pressures that make financial honesty difficult.

Vietnam leads the region with 66% of respondents providing accurate financial information, making it Southeast Asia’s most transparent market. Our analysis shows this performance stems from a mix of deeply rooted cultural values that emphasize trust and community accountability, reinforced by socioeconomic conditions that do not push individuals to misrepresent their financial circumstances for survival or advantage.

Vietnam’s political model, which actively pursues anti-corruption initiatives, further strengthens transparency at both institutional and individual levels. This approach creates an environment where honest financial behavior aligns with broader social expectations and official policy goals.

Thailand records the second-highest financial honesty rate at 64%, reflecting how economic diversification and steady growth support conditions where transparency becomes beneficial. With multiple pathways to stability, Thailand avoids the survival pressures that often drive misrepresentation in more constrained economies.

In contrast to markets where economic stress overrides cultural norms, Vietnam’s development path has created space for traditional values of community trust to thrive without clashing with financial necessity. The alignment of cultural expectations, historical experience, political governance and economic realities produces a reinforcing cycle where honesty strengthens rather than threatens people’s social and economic prospects.

The Philippines records the highest financial misreporting rate at 47%, driven by three main factors: face-saving cultural norms, limited financial literacy and significant economic pressure. Our analysis shows that when societies place strong emphasis on social reputation while also facing financial hardship and education gaps, misrepresentation becomes a rational way to preserve social standing and maintain access to economic opportunities.

Indonesia shows similar results with misreporting at 45%, shaped by the same mix of cultural expectations, financial literacy gaps and economic challenges. In such environments, honest disclosure can risk both social exclusion and economic loss, so misrepresentation often serves as a protective strategy to safeguard community ties and financial access.

Both markets highlight how cultural traditions, education shortfalls and economic realities combine to create systemic barriers to transparency. When face-saving norms overlap with financial vulnerability and limited knowledge, the outcome is consistent patterns of misreporting across these societies.

Singapore’s misreporting rate of 41% presents a paradox given its overall affluence. Our findings suggest that the city-state’s highly competitive environment creates unique pressures where people manage their financial image strategically to protect social status and secure scarce premium resources such as housing, education and career opportunities. In this context, financial presentation acts as a competitive tool rather than a survival tactic, yet it still leads to high levels of misreporting through very different motivations.

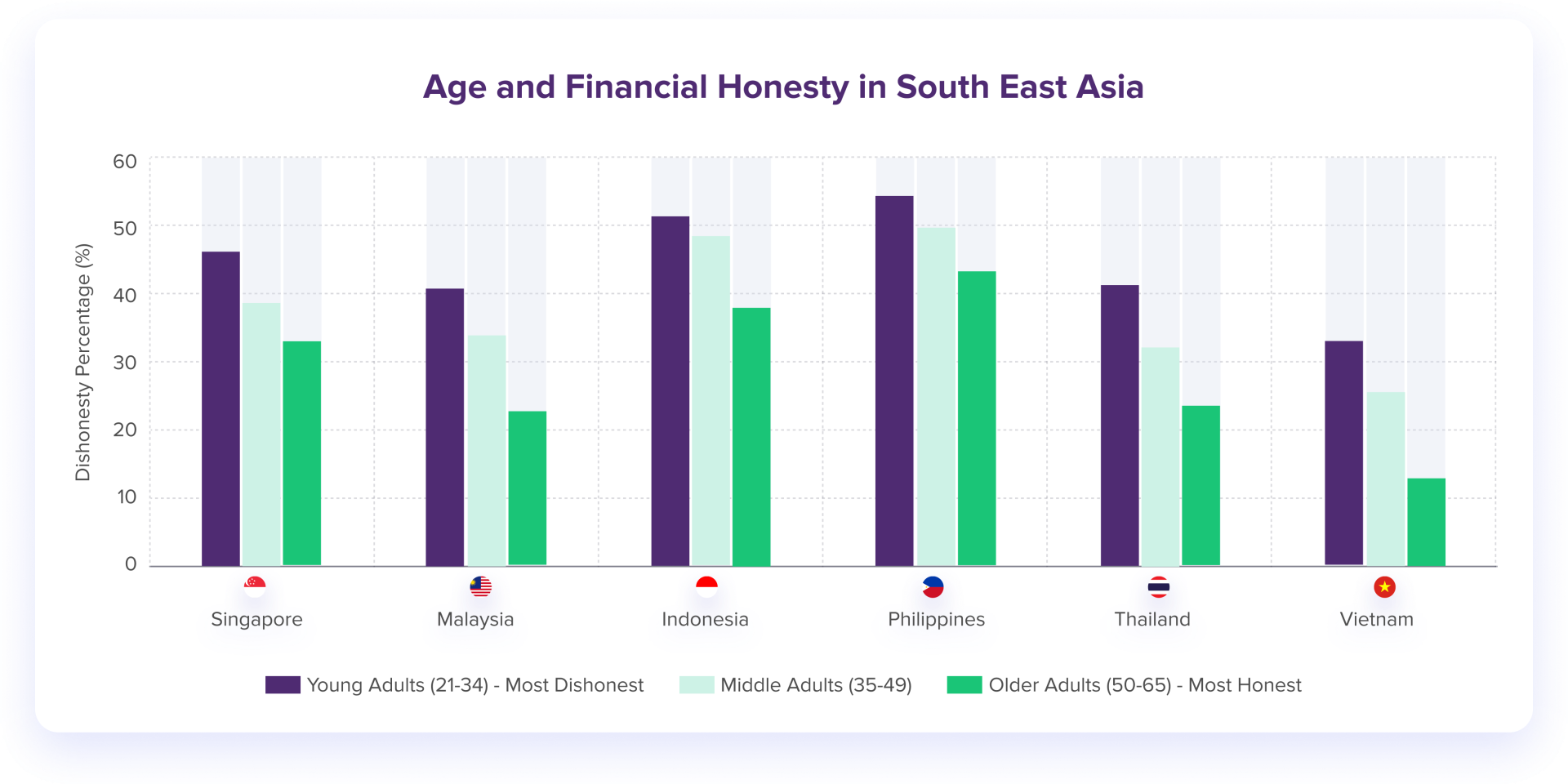

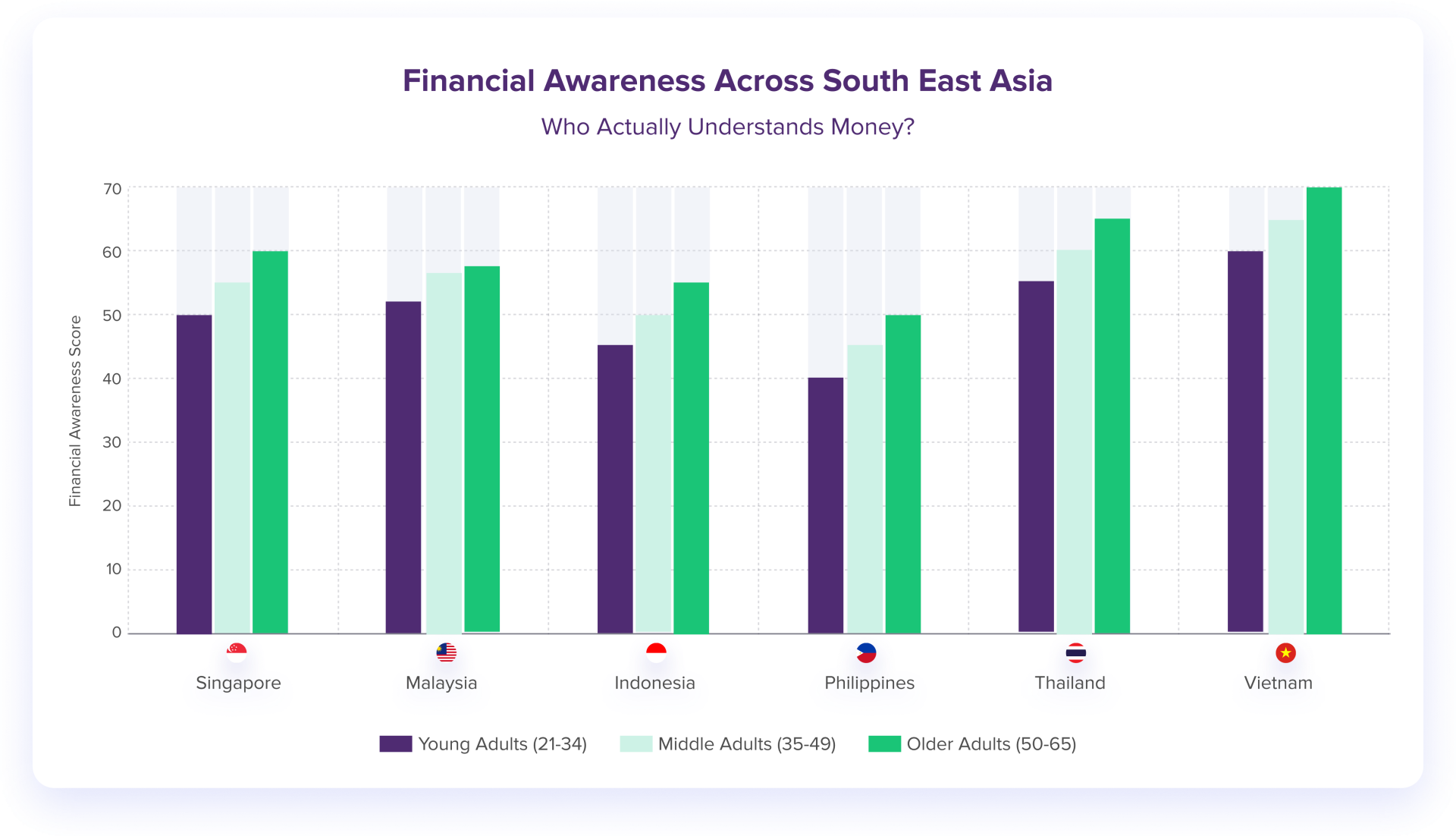

In every market included in our study, age plays a key role in shaping financial honesty. Young adults aged 21 to 34 consistently show the highest levels of misrepresentation, while older adults between 50 and 65 report their finances with the greatest transparency. This trend cuts across cultural and economic contexts, pointing to deeper generational factors that shape financial disclosure throughout Southeast Asia.

Young adults face overlapping pressures that encourage financial misrepresentation. Early career stages often coincide with financial vulnerability, creating situations where being fully transparent about limitations can hurt job prospects or social standing. Social media adds another layer of pressure by amplifying lifestyle expectations and tying financial image to personal identity in ways previous generations did not encounter. As a result, many young adults make financial decisions in environments that reward displays of material success, making it costly to acknowledge financial constraints openly.

Older adults, by contrast, benefit from established financial stability, fewer competitive pressures and years of experience that highlight the value of honesty in financial matters. This generation has learned through practice that transparent disclosure usually leads to better outcomes than misrepresentation, fostering long-term patterns that favor openness over short-term optimization.

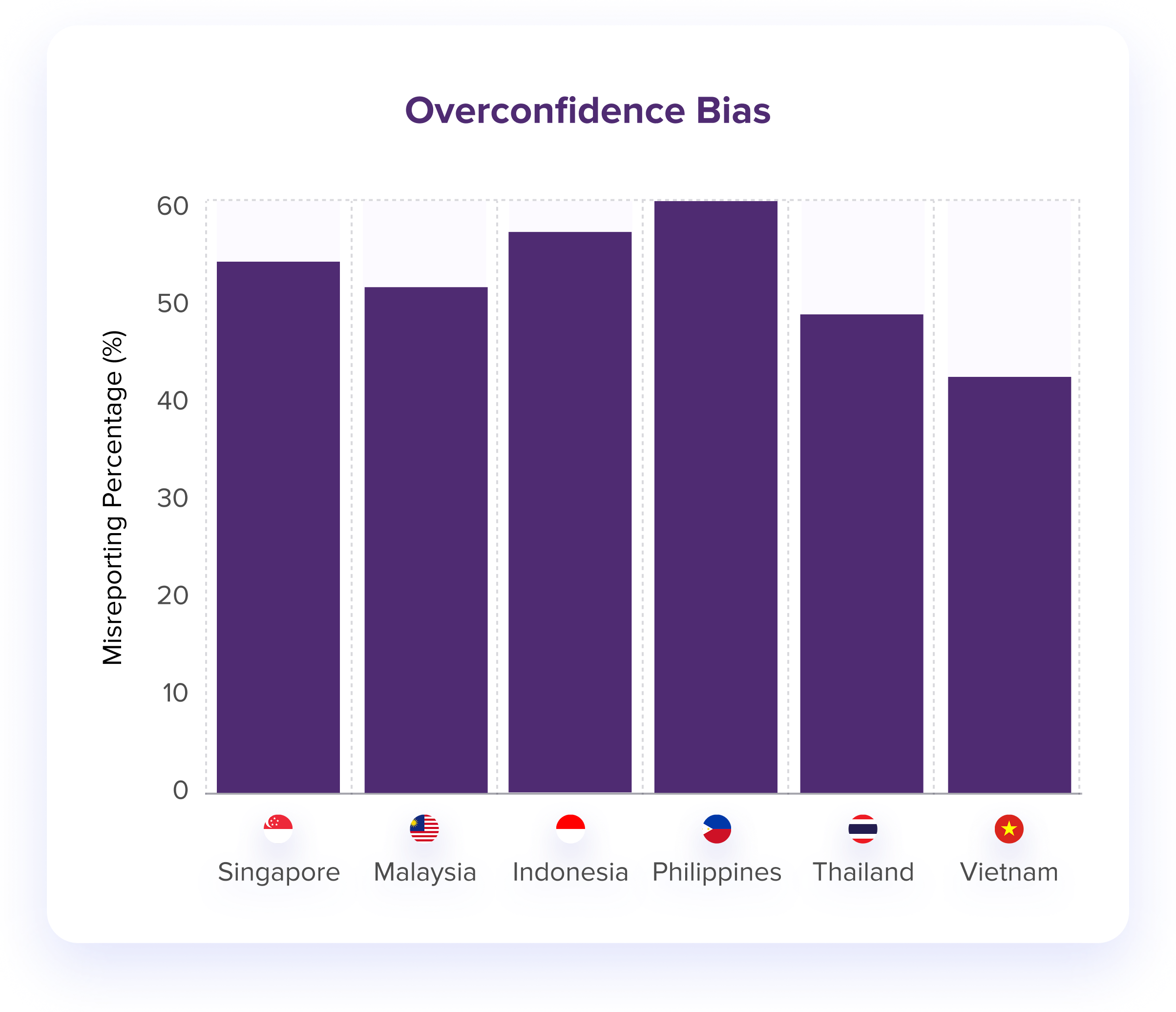

Beyond honesty, our study looked at three key psychological biases that shape financial decision-making across the region.

Overconfidence occurs when people believe they are better at handling finances than they truly are. This often leads to risky investments, low savings and poor spending habits.

The Philippines and Indonesia display particularly high levels of overconfidence, at 60% and 58% respectively, often among individuals already under financial stress. This creates a cycle where people make poor decisions at the very moments when mistakes are most costly.

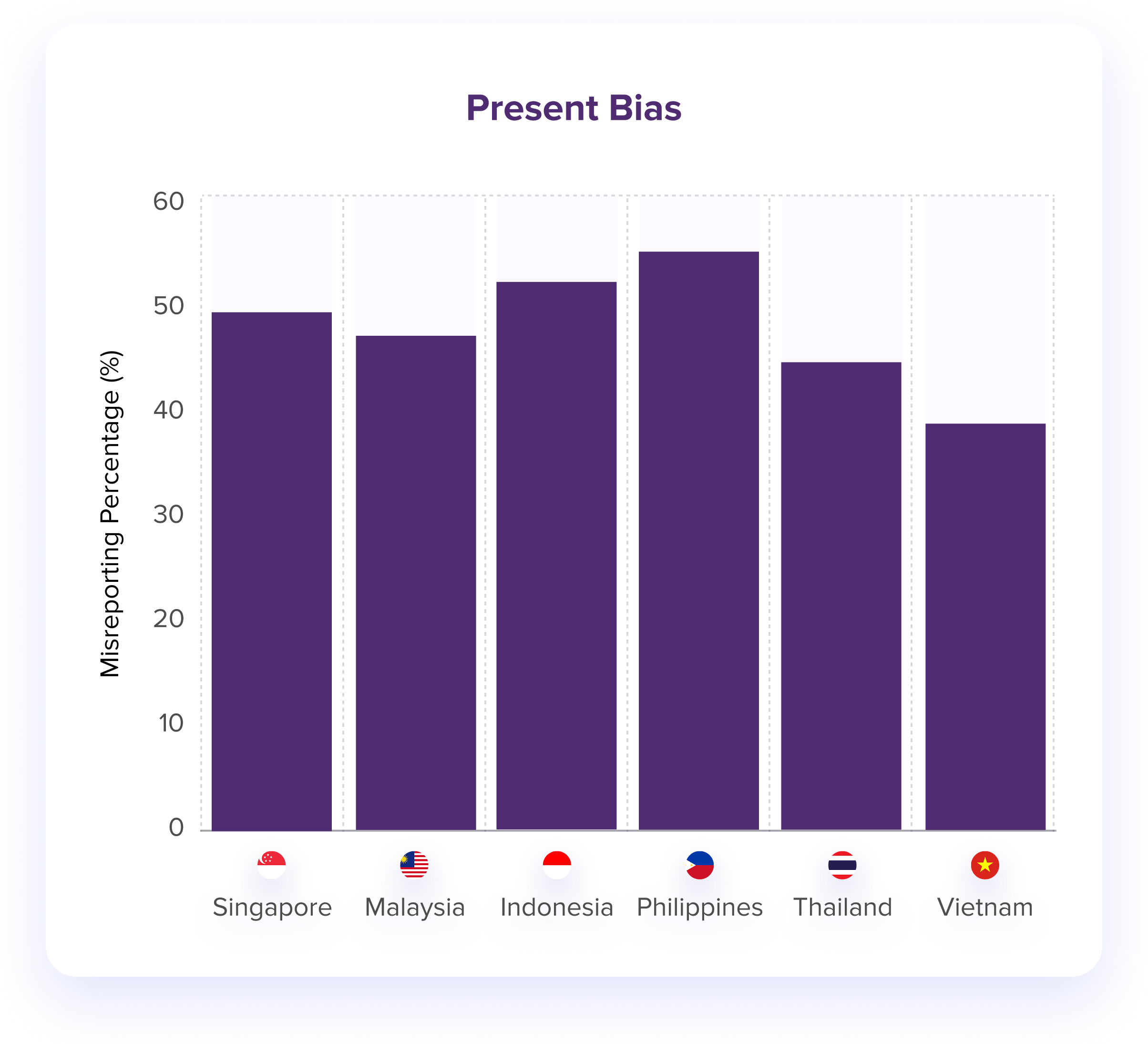

Present bias is the tendency to prioritize immediate rewards over more beneficial long-term choices. People with high present bias often spend money now rather than save for retirement, even when saving would clearly provide better outcomes.

The Philippines and Indonesia show particularly strong present bias at 68% and 65% respectively. This reflects the reality that when people struggle to meet daily needs, planning for the future becomes nearly impossible.

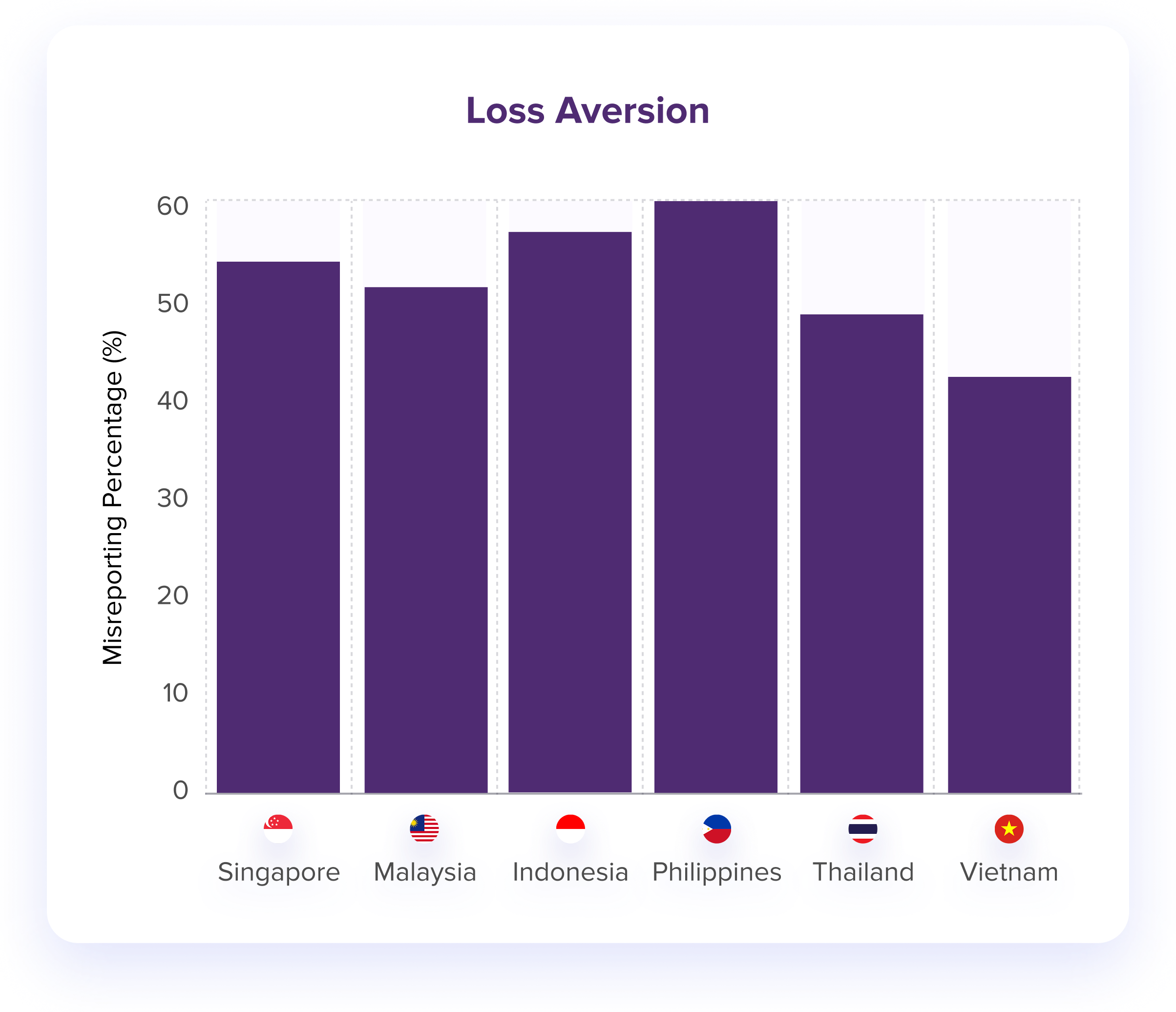

Loss aversion means the pain of losing $100 feels much stronger than the pleasure of gaining the same amount. While this mindset can discourage reckless spending, excessive loss aversion may also prevent people from making sound investments or taking calculated risks that could improve their financial situation.

Loss aversion affects at least half the population in every market except Vietnam, which reports the lowest level in the region at 45%. In all other countries, higher rates suggest that financial stress and cultural expectations amplify natural psychological tendencies to avoid risk.

We measured financial awareness, meaning how well people understand basic concepts such as interest rates, inflation and risk. The results closely mirror overall honesty patterns.

Vietnam’s high level of financial awareness is not simply the result of stronger education systems. It reflects a culture where financial stability and wellbeing are valued and shared within communities. Economic opportunities combined with government policies that actively fight corruption create an environment where transparency is both expected and rewarded, reinforcing cultural values that support honest financial behavior.

Thailand’s strong financial awareness comes from economic stability and diversified opportunities that make long-term planning both possible and worthwhile. When people trust in stable conditions and have multiple income pathways, they are more likely to invest time in learning financial concepts because that knowledge has clear practical value.

Unlike markets where economic pressures overwhelm cultural norms, both Vietnam and Thailand have built environments where traditional values coexist with financial realities. This alignment between cultural expectations and economic conditions creates reinforcing cycles in which financial honesty strengthens rather than threatens individual prospects.

By contrast, countries under economic stress often struggle to build financial awareness because day-to-day survival takes priority over learning. Competitive pressures can also discourage knowledge sharing when doing so might reduce one’s own advantages.

The Philippines and Indonesia highlight this challenge, where immediate financial pressures combined with face-saving cultural norms create environments in which admitting knowledge gaps or seeking financial guidance carries social risks.

Limited economic opportunities and high living costs relative to income further add to the strain. When financial struggles must be hidden to preserve social status and opportunities for advancement remain scarce, community-based financial learning becomes limited. This cycle reinforces low financial literacy across both populations.

The biggest factor shaping financial honesty is not education or income but culture in combination with economic pressure. Each country shows distinct patterns based on how cultural needs for saving face align with economic realities.

Singapore’s 41% misreporting rate despite high incomes reflects the unique pressures of living in an expensive, status-conscious city-state where financial appearance directly influences social and professional opportunities.

As a regional financial hub, Singapore fosters a highly competitive environment where financial positioning is essential for access to premium resources such as top housing, schools and career opportunities. Housing costs consume a large share of income even for well-paid professionals, creating a gap between actual disposable income and perceived wealth. Social media heightens these pressures by constantly displaying curated lifestyles.

The country’s diverse expat community adds further complexity. Locals often feel they are competing with foreigners while expats face pressure to show they are thriving in one of the world’s most expensive cities.

The outcome is a pattern of strategic financial misrepresentation. It is not driven by desperation but by competitive necessity where admitting financial limits risks losing ground to others who appear stronger.

The Philippines' high dishonesty rate (47%) reflects a convergence of economic stress, face-saving cultural norms and insufficient financial literacy. "Pakikipagkunware" (maintaining appearances) becomes essential when people facing limited economic opportunities and elevated cost of living must preserve community standing and family honor.

The pressure to uphold face despite financial struggles is enormous. Admitting difficulties brings shame to the entire family and risks exclusion from social support networks that provide vital help. Financial misrepresentation becomes a strategy of cultural preservation, allowing people to maintain social status when economic reality clashes with community expectations.

Indonesia’s moderate dishonesty rate of 45% arises from a culture that prioritizes harmony and community status over absolute honesty. With limited access to formal financial services and constrained economic opportunities, people rely heavily on informal networks for support, making face-saving and status preservation more important than transparency.

The emphasis lies in safeguarding social standing within community hierarchies. The goal is to maintain harmony and a respected position in networks that provide security. Open disclosure of financial struggles could cause discomfort, reduce status and jeopardize relationships that serve as crucial informal safety nets.

Vietnam’s exceptional honesty rate of 66% reflects a culture where trust functions as valuable social currency that enhances rather than threatens social status. Communities reward financial honesty because trustworthy individuals are seen as better long-term partners for both business and personal relationships, supported by expanding economic opportunities and active government anti-corruption measures.

Unlike markets where admitting financial difficulties carries social costs, Vietnamese culture positions financial transparency as a sign of strength and community contribution. By building genuine trust through honest behavior, people gain both social status and economic opportunities instead of putting them at risk.

Thailand’s strong honesty rate of 64% shows how modern financial infrastructure can coexist with traditional community systems to promote transparency even when governance challenges remain.

The country leads Asia-Pacific with 94% adoption of the government-backed PromptPay system, which creates digital audit trails that make financial misrepresentation more difficult. The 1997 financial crisis reshaped the banking sector, resulting in 44.62% cost efficiency—third-best in ASEAN—and comprehensive credit bureau coverage for 60 million individuals.

At the same time, Thailand maintains 80,000 Village Fund committees that achieve 95% loan recovery rates through social capital rather than collateral. Together with 99.6% healthcare coverage that reduces financial desperation, these systems create multiple pathways that reinforce honest financial behavior.

Economic conditions create consistent patterns in financial honesty across Southeast Asian markets. The data shows clear links between financial pressure, economic opportunities and reporting accuracy, highlighting how structural factors shape individual transparency behaviors.

| Country | Economic Environment | Primary Drivers | Dishonesty Rate |

|---|---|---|---|

| Philippines | Limited opportunities + High cost of living | Economic stress + Face-saving culture + Financial literacy gaps | 47% |

| Indonesia | Constrained mobility + Rising costs | Economic pressure + Social harmony preservation + Education deficits | 45% |

| Singapore | High competition + Resource scarcity | Competitive positioning + FOMO culture | 41% |

| Malaysia | Moderate development + Balanced pressures | Mixed economic and social factors | 38% |

| Thailand | Stable growth + Cultural moderation | Manageable economic conditions | 36% |

| Vietnam | Expanding opportunities + Anti-corruption focus | Economic growth + Institutional transparency + Community values | 34% |

Vietnam and Thailand illustrate how expanding opportunities and institutional stability can strengthen honest financial behavior. In Vietnam, government anti-corruption initiatives create an environment where transparency is strategically advantageous. In Thailand, economic diversification and steady growth provide multiple paths to success without forcing survival-driven compromises.

These conditions allow cultural values such as community trust in Vietnam and moderation in Thailand to align with economic reality, creating reinforcing cycles where financial honesty enhances rather than threatens individual prospects.

Both markets show how limited opportunities and high living costs relative to income create conditions where face-saving cultural norms outweigh transparency. When advancement is constrained and basic expenses consume much of household income, people develop rational incentives to misrepresent finances as a way to guard against both economic and social exclusion.

The mix of financial stress, cultural pressure to maintain appearances and low financial literacy produces reinforcing cycles where honesty carries high risks while strategic misrepresentation provides protection from both disadvantage and stigma.

Despite high incomes, Singapore’s hyper-competitive environment generates unique pressures where financial positioning becomes critical for access to scarce premium resources. The city-state’s economic model, built on competition for limited high-value opportunities, systematically incentivizes financial optimization regardless of underlying security.

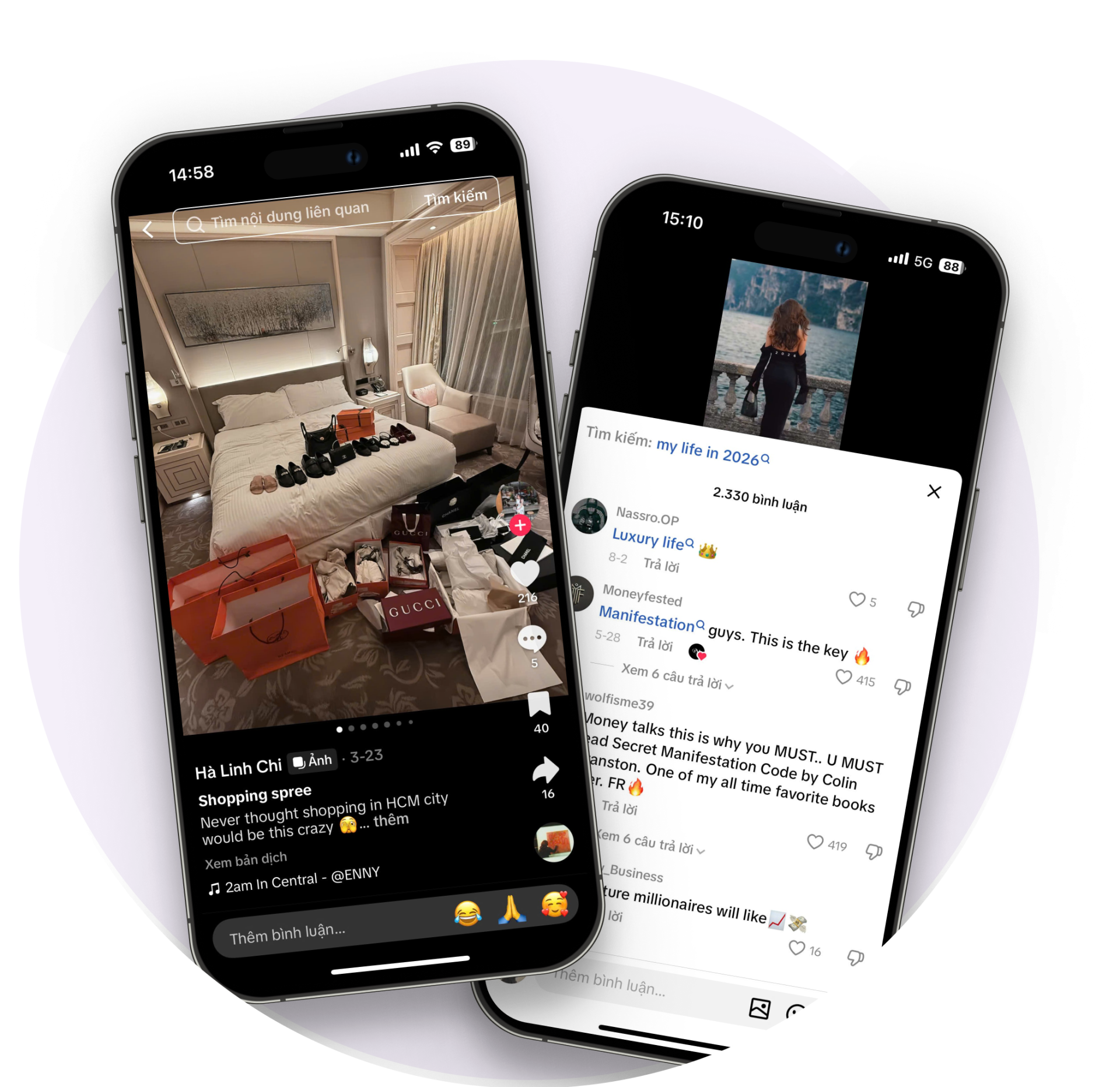

Digital transformation is steadily reducing transparency across Southeast Asia, introducing new pressures and opportunities for misrepresentation that build on existing cultural and economic challenges around disclosure.

Social media has intensified financial dishonesty by creating constant pressure to display success regardless of reality. The endless stream of curated wealth and lifestyle content pushes individuals to maintain digital personas that often exceed their actual financial capacity.

Young adults in particular feel pressure to showcase prosperity through lifestyle posts, luxury goods and travel, leading to debt-financed consumption and deliberate misrepresentation. This digital competition for status expands beyond traditional face-saving norms, making honest acknowledgment of financial limits socially damaging in every market.

The rise of Buy Now Pay Later services and instant lending apps has made misrepresentation easier and more tempting. These platforms often use minimal verification, letting users obtain credit based on optimistic self-reporting rather than proven financial strength. Multiple apps and informal credit sources create fragmented debt that can be hidden from banks, families and even from borrowers themselves. The convenience of accessing small sums across many platforms fuels systematic misrepresentation that builds over time into unsustainable debt burdens.

Digital financial services increasingly provide tools that enable new forms of deception through alternative data manipulation and curated social presence. Users now learn to shape their digital footprints, online behavior and social media activity to influence algorithm-driven credit assessments, resulting in more sophisticated strategies of misrepresentation.

The transition from documentation-based lending to behavioral analytics and social scoring has created new categories of “acceptable” misrepresentation, where optimizing one’s digital persona becomes a rational path to securing better financial terms.

Ultimately, digital transformation has accelerated long-standing challenges around financial transparency while introducing entirely new mechanisms of systematic misrepresentation across Southeast Asian markets.

Our study shows that financial transparency arises from the interaction of cultural values and economic realities rather than education or policies alone. Vietnam demonstrates how cultures that emphasize trust and community accountability can sustain honest financial behavior, while other markets highlight how different cultural and economic pressures shape distinct patterns.

Financial honesty reflects deep cultural values interacting with economic conditions, not only education or government programs.

For regulators, financial institutions and consumers across Southeast Asia, these patterns provide crucial context for personal and policy decisions. The findings show that financial behavior reflects rational responses to cultural and economic environments rather than individual character flaws.

Most importantly, this study demonstrates that sustainable financial success requires working with rather than against cultural-economic realities. Markets that achieve natural alignment between cultural values and economic incentives around financial transparency create lasting advantages, while those facing cultural-economic conflicts require recognition and adaptation strategies that acknowledge underlying behavioral patterns.

DISCLAIMER

This publication is issued by ROSHI Pte Ltd (UEN 202222480E) (“ROSHI”) and is provided for informational purposes only. It is intended for ROSHI and its clients. The analysis offers perspectives on financial behavior and trends in Southeast Asia but may be incomplete or condensed. ROSHI makes no representation or warranty as to accuracy and accepts no responsibility for decisions made based on this report. All figures are illustrative and do not bind ROSHI. ROSHI provides marketing and matchmaking services to connect clients with lending partners but does not directly offer lending or financial advisory services under the regulation of the Monetary Authority of Singapore. Readers should seek professional advice before making any financial decisions.

SURVEY METHODOLOGY

This study surveyed around 300 online respondents in each of six Southeast Asian markets, with equal representation across three age groups (21-34, 35-49, 50-65). The survey examined financial honesty patterns and behavioral biases across the region.