SINGAPORE MAINTAINS HIGHEST REGIONAL CREDIT CARD DEBT

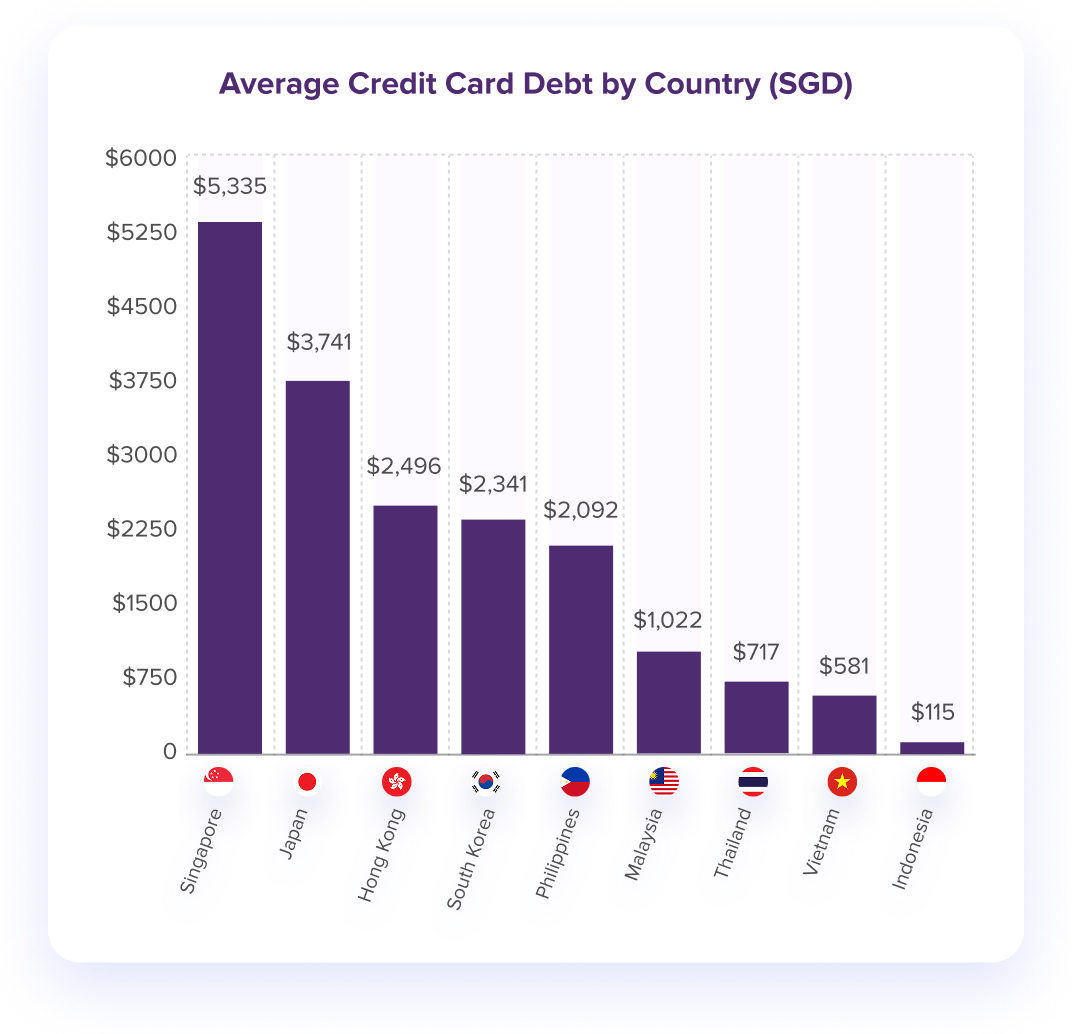

Singapore’s S$5,335 average credit card debt reflects a sophisticated financial ecosystem where high earners (S$6,167.60 monthly income) leverage credit strategically for rewards, convenience, and cash flow management. Unlike regional neighbors, Singapore’s debt levels are supported by strong income capacity and advanced financial infrastructure, positioning cardholders to manage obligations effectively.

OTHER ASEAN COUNTRIES FACE SIGNIFICANT DEBT SUSTAINABILITY CHALLENGES

Malaysia (79% of monthly income), Thailand (92% of monthly income), and Vietnam (127% of monthly income) show concerning debt-to-income ratios approaching or exceeding one month’s earnings. The Philippines faces the most critical situation with credit card debt representing 425% of monthly income. Indonesia’s low formal credit card debt masks underlying financial stress, as limited banking access drives reliance on informal credit sources.

STRATEGIC CREDIT CARD DEBT MANAGEMENT OFFERS OPPORTUNITIES

High credit card interest rates (24-26% annually) across the region create significant opportunities for strategic debt management. Current low inflation environments (Singapore at 2.4%) combined with debt consolidation through lower-interest personal loans can substantially reduce borrowing costs and accelerate repayment timelines for consumers seeking financial relief.

Southeast Asia demonstrates significant variation in credit card usage and debt levels. Singapore leads with the highest average credit card debt at S$5,335 per cardholder, far exceeding other nations in the region. This high figure can be attributed to several factors: Singapore's advanced financial ecosystem, high disposable income (average monthly income of S$6,167.60), widespread card acceptance, and a culture that embraces digital payments.

In stark contrast, Indonesia presents the lowest average credit card debt at S$148 per cardholder, reflecting limited credit card penetration in this primarily cash-based economy where the average monthly income is S$530.80. The Philippines (S$2,092 average debt with S$492.26 monthly income), Hong Kong (S$2,496 debt with S$6,032.26 income), and Japan (S$3,741 debt with S$4,335.66 income) occupy the middle to high tier with moderate to substantial average credit card debt levels.

Vietnam has maintained stable average credit card debt at S$581 (average monthly income: S$456.85), with reports indicating that credit card circulation increased 2.4 times from 2018 to mid-2023, with transaction value growing by 35%. This reflects rapid financial modernization and increased credit adoption in this emerging economy.

These variations highlight the diverse financial landscapes across the region, with credit card adoption closely tied to economic development, banking accessibility, and consumer behavior patterns. What's particularly notable is how credit card debt corresponds with broader household debt patterns, though with important distinctions that reveal cultural attitudes toward different forms of borrowing.

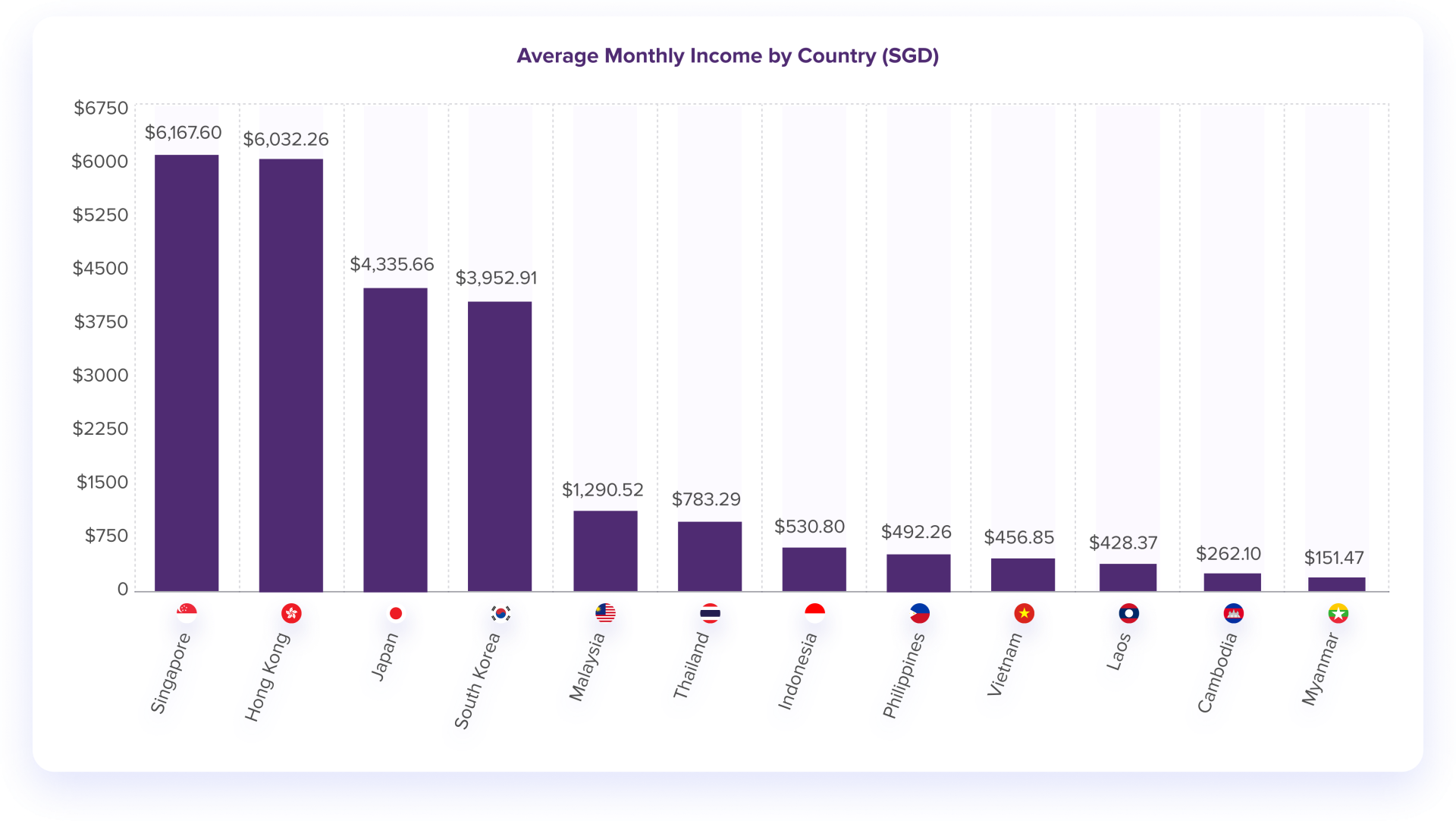

A crucial dimension in understanding regional credit card debt patterns is the relationship between debt and income levels. Singapore leads the region with the highest average monthly income at S$6,167.60, followed by Hong Kong (S$6,032.26) and Japan (S$4,335.66). This higher earning capacity partially explains Singapore's high average credit card debt (S$5,335), as it represents a manageable percentage of monthly income for many cardholders.

However, income doesn't always correlate directly with credit card debt. The Philippines presents a concerning anomaly, with relatively high credit card debt (S$2,092) despite a modest average monthly income of S$492.26. This creates a debt-to-income ratio that far exceeds regional norms and suggests potential financial vulnerability among Filipino cardholders.

South Korea and Japan demonstrate more balanced approaches, with credit card debt (S$2,341 and S$3,741 respectively) that, while substantial, represents a smaller percentage of their higher average monthly incomes (S$3,952.91 and S$4,335.66). Malaysia, Thailand, and Vietnam maintain credit card debt levels that are roughly proportional to their income levels, reflecting more sustainable borrowing practices.

Indonesia's extremely low average credit card debt (S$148) compared to its average monthly income (S$530.80) further emphasizes the structural factors that influence credit adoption beyond mere affordability considerations.

For Singaporean residents, this income-adjusted perspective provides valuable context: while absolute credit card debt figures are high, the relatively strong income levels create greater capacity for managing and servicing this debt, provided it is approached with appropriate financial discipline.

| Country | Cards in Circulation | Average Credit Card Debt (SGD) |

|---|---|---|

| Vietnam | 13 million | $581 |

| Malaysia | 9.92 million | $1,022 |

| Thailand | 9.36 million | $717 |

| Indonesia | 17.2 million | $115 |

The credit card landscape across ASEAN reveals stark disparities in adoption rates. Vietnam has seen explosive growth with over 13 million credit cards in circulation as of 2024, representing a significant increase in recent years, with transaction values growing steadily. This rapid expansion reflects Vietnam's accelerating financial modernization despite relatively modest average card debt (S$581).

Malaysia maintains 9.92 million credit cards in circulation with total outstanding debt of S$35.1 billion (2024), reflecting robust adoption in this middle-income nation. Thailand faces significant challenges with outstanding credit card loans reaching S$21.6 billion as of March 2024.

Indonesia, despite its huge population, has 17.2 million credit cards in circulation with transaction value at S$24.9 billion (2024), highlighting significant growth potential in this underbanked market. For Singaporean residents and businesses, these trends signal opportunities for financial innovation and cross-border expansion into less saturated markets.

| Country | Monthly income | Average Credit Card Debt (SGD) | Debt to Income | Risk Level |

|---|---|---|---|---|

| Philppines | $492.26 | $2,092 | 425% | Critical |

| Vietnam | $456.85 | $581 | 127% | High |

| Thailand | $783.29 | $717 | 92% | Moderate |

| Singappore | $6,167.60 | $5,335 | 86% | Moderate |

| Japan | $4,335.66 | $3,741 | 86% | Moderate |

| Malaysia | $1,290.52 | $1,022 | 79% | Moderate |

| South Korea | $3,952.91 | $2,341.00 | 59% | Low |

| Hong Kong | $6,032.26 | $2,496 | 41% | Low |

| Indonesia | $530.80 | $115 | 21% | Low |

Critical Risk

Philippines 425% debt-to-income ratio indicates severe financial stress

Best Balance

Hong Kong: 41% ratio with high income shows healthy credit management

Region Leader

Singapore: Highest debt but manageable at 87% due to high income

To fully understand credit card debt patterns, we need to examine them within the broader context of overall consumer borrowing behaviors across the region. Credit cards represent just one facet of household financial obligations, and their usage patterns often reflect deeper financial trends and preferences.

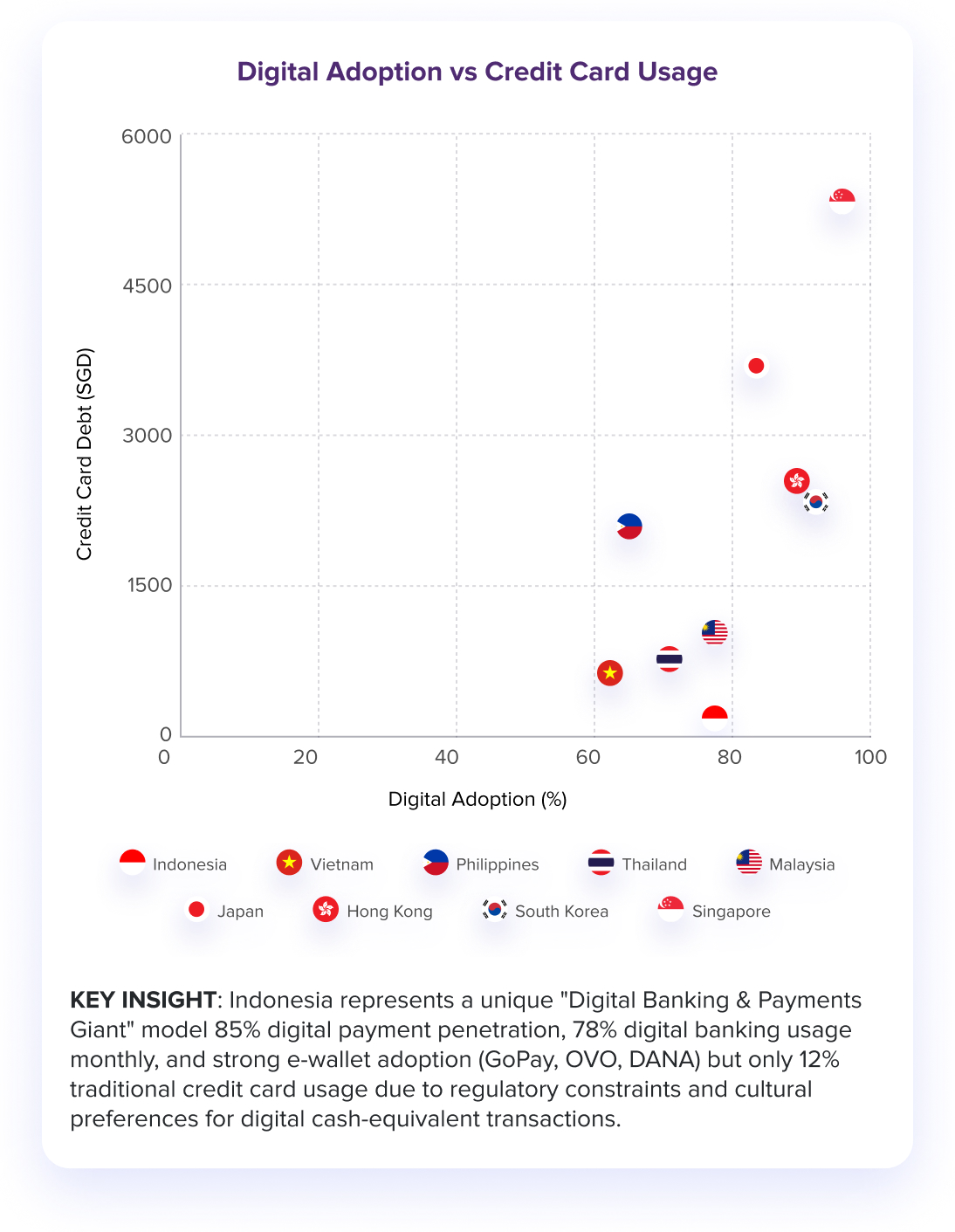

In South Korea, high credit card debt (S$2,341) exists alongside substantial overall household borrowing (91.7% of GDP), suggesting a cultural comfort with leveraging various forms of credit. Conversely, Indonesia combines minimal credit card debt (S$148) with modest total household borrowing (10.0% of GDP), reflecting not just cultural preferences but also restricted access to consumer financial services and stringent qualification criteria for mortgage and secured lending products.

Singapore presents an intriguing case study, with the region's highest average credit card debt (S$5,335) but a moderate overall household debt burden (51.9% of GDP). This disconnect suggests that Singaporeans approach different credit instruments with varying attitudes - embracing credit cards for convenience and rewards while remaining relatively conservative with other forms of borrowing.

The Philippines shows another interesting pattern, with significant credit card debt (S$2,092) despite low overall household leverage (11.7% of GDP), indicating a specific preference for card-based borrowing among those with access to formal financial services.

These varying relationships between credit card usage and broader borrowing patterns provide valuable insights for both consumers and financial service providers, highlighting the need for tailored approaches that recognize the unique financial behaviors in each market.

Across ASEAN, traditional credit card debt is increasingly being shaped by innovative digital technologies and alternative payment solutions. Singapore leads this transformation with numerous digital banks and fintech platforms offering enhanced credit card features and management tools. Similar innovation is emerging in Malaysia, Thailand, and Vietnam, where mobile penetration often exceeds banking access.

Buy-Now-Pay-Later (BNPL) services have gained significant traction, particularly among younger consumers who may avoid traditional credit cards while still seeking credit-based purchasing power. In Indonesia, where credit card penetration remains relatively low at just 17.2 million cards in a country of over 270 million people, digital lending platforms have seen exponential growth, serving previously underbanked populations.

For Singaporean consumers, this digital transformation offers both opportunities and challenges in managing credit card debt: greater convenience and potentially lower costs must be balanced against the risk of accumulated debt across multiple platforms that may be less visible than traditional credit card statements.

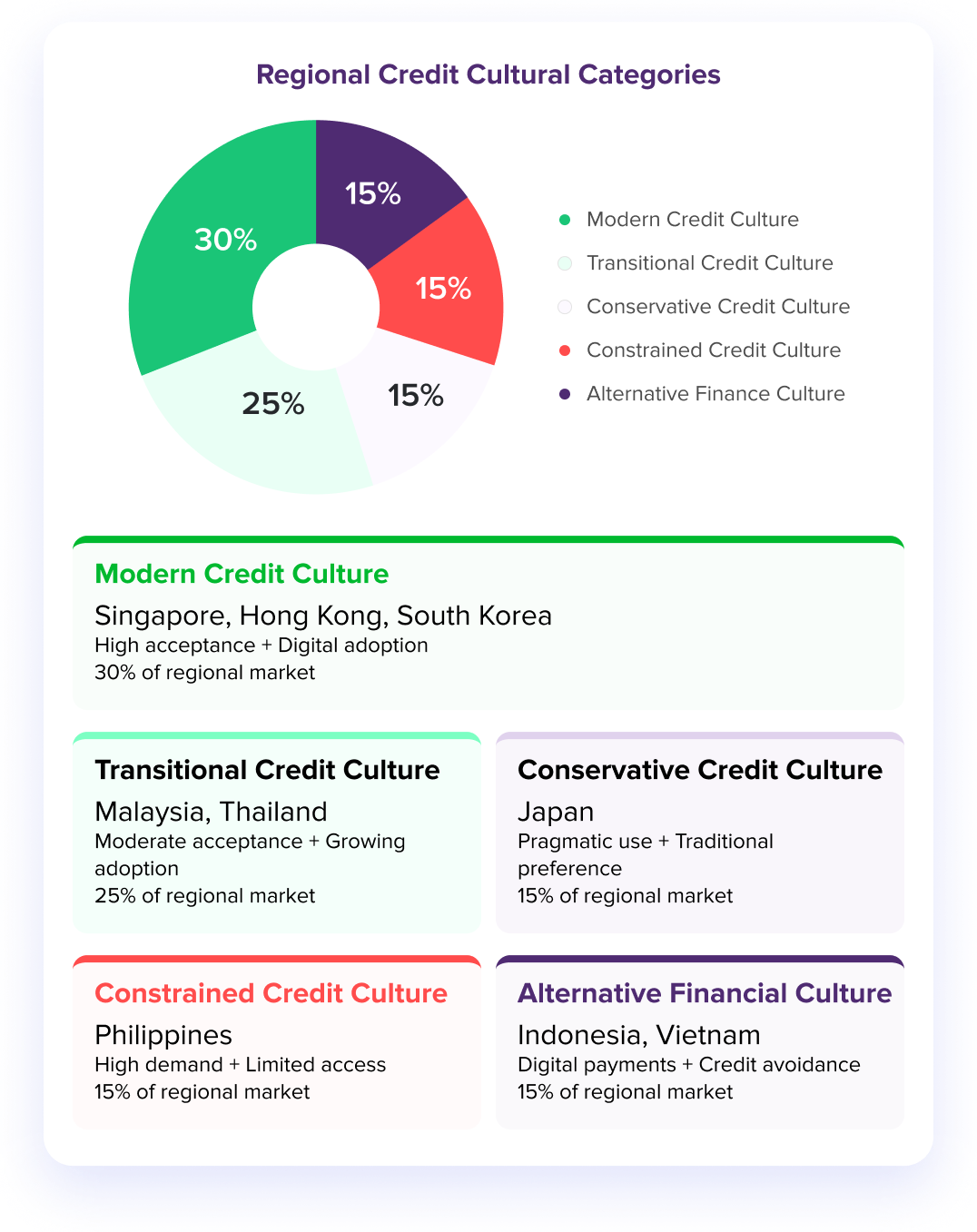

The varying approaches to credit card usage across ASEAN reflect deeply ingrained cultural attitudes toward borrowing and financial management. Japan's relatively moderate credit card debt (S$3,741) despite its economic advancement and high average monthly income (S$4,335.66) demonstrates a cultural preference for measured credit card utilization. Similar conservative approaches are evident in Indonesia's minimal credit card debt (S$148) despite reasonable income levels (S$530.80).

In contrast, Singapore's high credit card debt (S$5,335) reflects greater comfort with leveraging credit cards for daily transactions and larger purchases, supported by the region's highest average monthly income (S$6,167.60). The Philippines presents a unique case where cultural factors and financial circumstances have led to significant credit card debt (S$2,092) relative to income (S$492.26).

These cultural distinctions influence not just individual borrowing behaviors but also how consumers approach credit card management across different markets. For financial institutions and credit card issuers, recognizing these cultural dimensions is essential for developing effective educational initiatives and appropriate credit products.

70% of the region falls into transitional or emerging credit cultures, indicating massive opportunity for financial education and product innovation. Indonesia's "Alternative Financial Culture" represents a unique global model.

A critical factor influencing credit card debt burdens across the region is the current inflation environment. As of 2025, most ASEAN nations enjoy relatively moderate inflation, creating favorable conditions for credit card debt repayment. Singapore's inflation rate stands at 2.4%, while Thailand (0.84%) and Indonesia (1.03%) present even lower figures.

This contrasts sharply with Myanmar (14.2%) and Laos (11.2%), where high inflation erodes purchasing power and complicates credit card debt management. Cambodia (4.7%), Japan (3.6%), and Vietnam (3.13%) maintain moderate inflation rates that still allow for effective servicing of credit card obligations.

For most regional consumers, the current low-to-moderate inflation environment presents an opportunity to reduce credit card debt burdens in real terms, though this advantage could shift if global economic conditions change.

For strategic debt management, Singaporean residents should consider that the current inflation rate means real interest costs on credit card debt (often 24-26% annually) remain extremely high in real terms, emphasizing the importance of prioritizing credit card debt reduction while conditions remain favorable.

| Country | Nominal Credit Card Fee | Inflation Rate 2025 | Real Cost | Average Credit Card Debt | Annual Interest Burden |

|---|---|---|---|---|---|

| Singappore | 26% | 2.4% | 23.6% | S$5,335 | S$1,259 |

| Japan | 18% | 3.6% | 14.4% | S$3,741 | S$539 |

| Hong Kong | 22% | 2% | 20% | S$2,496 | S$499 |

| Philppines | 24% | 1.8% | 22.2% | S$2,092 | S$464 |

| South Korea | 20% | 2.1% | 17.9% | S$2,341 | S$419 |

| Malaysia | 25% | 1.5% | 23.5% | S$1,022 | S$240 |

| Thailand | 24% | 0.84% | 23.16% | S$717 | S$166 |

| Vietnam | 22% | 3.13% | 18.87% | S$581 | S$110 |

| Indonesia | 24% | 1.03% | 22.97% | S$115 | S$26 |

Regional governments have adopted varying approaches to managing credit card debt levels. Singapore has implemented robust financial literacy programs alongside prudent lending regulations to maintain sustainable credit card debt levels. The Singapore government is also providing Community Development Council (CDC) Vouchers to Singaporean households. In January 2025, each household received S$300 in CDC Vouchers, and another S$500 will be issued from May 2025. These vouchers are part of the Assurance Package to help households with daily expenses and potentially reduce reliance on credit card financing.

Malaysia has introduced stricter lending criteria specifically targeting credit cards to address concerns about rising debt levels. Thailand, facing significant credit card debt challenges, has expanded debt consolidation programs and implemented interest rate caps on credit card loans. Indonesia's conservative regulatory approach has limited credit card expansion but potentially restricted financial inclusion for underserved populations.

For consumers across the region, understanding these regulatory frameworks is increasingly important as credit card options expand, offering new borrowing opportunities that may operate under different regulatory standards than domestic options.

For Singaporean residents, the regional credit card debt landscape offers valuable perspective for personal financial management. Despite having the region's highest average credit card debt (S$5,335), Singapore's relatively low inflation rate (2.4%), high average monthly income (S$6,167.60), and robust financial infrastructure create conditions where strategic credit card debt management can be highly effective.

Prioritizing high-interest credit card debt remains crucial, particularly given that Singapore's average credit card interest rates significantly outpace inflation. For those facing multiple credit card obligations, understanding how different ASEAN markets structure their consumer credit can provide insights into alternative approaches, including debt consolidation, balance transfers, and emerging digital lending options.

DISCLAIMER

This information herein is published by ROSHI Pte Ltd (UEN 202222480E) (“ROSHI”) and is for information only. This publication is intended for ROSHI and its clients to whom it has been delivered. This report contains aggregated insights derived from various public sources including:

https://www.reuters.com/

https://pia.gov.ph/

https://www.tradingview.com/

https://tradingeconomics.com/

https://www.statista.com/

The analysis aims to provide perspectives on credit card debt developments and trends in Singapore, South East Asia and some neighbouring countries such as Japan and South Korea but may be incomplete or condensed. ROSHI makes no warranty to accuracy or assumes any responsibility for decisions made based on this report. Figures used are for illustration and do not bind ROSHI. ROSHI performs marketing and matchmaking services to connect clients with lending partners but does not directly offer any lending or financial advisory services under regulation by the Monetary Authority of Singapore. Users of this report should consult professional advisors before engaging in any transaction.