Our Expert says

Is a Small Cash Loan Right for You?

If you only need a few hundred dollars, borrowing a smaller amount is almost always better than borrowing more.

A $500 loan at maximum interest costs about $70 in fees and interest over one month. A $2,000 loan? That's $280. If you only needed $500, you'd have paid $210 extra for nothing.

My advice, calculate exactly what you need, add a small buffer if necessary and borrow the exact amount.

Trinh Thanh

Head of Research

Tips for Borrowing Smaller Amounts

Calculate the exact amount you need

Don't round up to, If you need $480, borrow $500 and not $1,000.

Choose the shortest repayment timeline you can afford

1 month costs less than 3 months in total interest but only choose this if you can actually make the repayment.

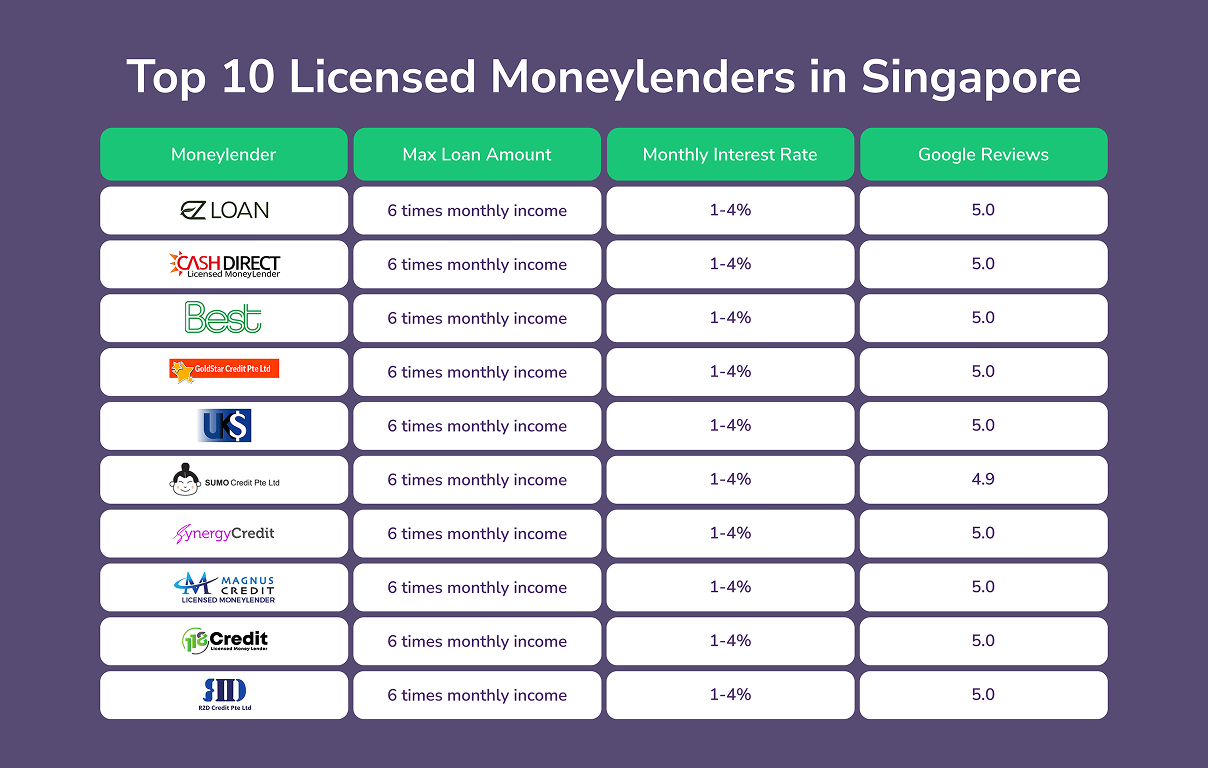

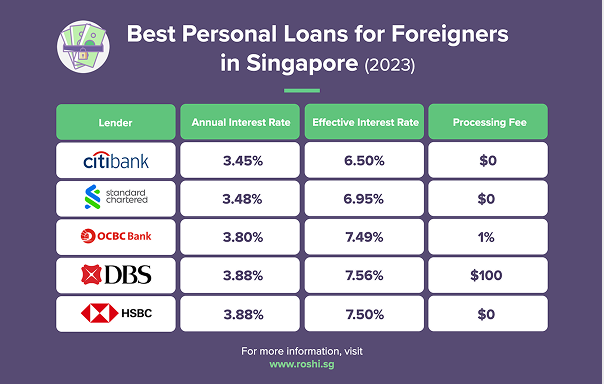

Compare lenders as rates vary

Not all licensed moneylenders charge 4% monthly interest rate some offer half of that, especially for lower amounts.

Avoid repeat borrowing

One small loan can help but multiple small loans every month is a clear warning sign.

Have a repayment plan

Before you borrow, know exactly how you're gonna repay via what account and at what date.

Loan Amount Overview

Which Amount Do You Need?

Quick overview to choosing the right loan amount:

| If you need | Consider borrowing | Example use |

|---|---|---|

| Under $300 | $300-$500 | Utility bill, groceries |

| $300-$500 | $500 | Minor repair, small medical bill |

| $500-$700 | $600 | Larger utility bills, small emergency |

| $700-$900 | $800 | Minor car or appliance repair |

| $900+ | $1,000 or Personal Loan | Larger expenses |