Our Expert says

When Should You Get an Emergency Loan?

An emergency loan can be a lifeline when you're facing an unexpected crisis but it's important to pause and assess your situation first.

Ask yourself if this is a one-time emergency or a sign of a bigger problem? If it's the latter, consider speaking with a credit counsellor.

For real emergencies where you need money within hours, licensed moneylenders offer a faster alternative to banks. Just make sure you borrow only what you

need and have a clear plan to repay.

Trinh Thanh

Head of Research

Borrowing Checklist

Answer these questions before applying:

Is this a real emergency?

Could this expense wait a few days? If yes, you may have time to explore bank loan options, borrowing from family or using savings.

Have I checked my savings first?

Even a small emergency fund can help. Check if you can cover part of the expenses without borrowing.

Can I repay this?

Use our loan calculator to see monthly repayments. Can you afford this on top of your existing expenses?

Am I borrowing only what I need?

Borrow the minimum needed as interest and fees can add up

Do I have a repayment plan?

Know exactly how you'll repay the loan amount at what date and from what account you’ll make the repayments.

Where to Get Help

Before taking a loan, consider seeking help:

CPF Withdrawal

You may be able to withdraw CPF for medical emergencies.

Learn more at cpf.gov.sgMedifund

Government assistance for medical bills if you can't afford them.

Check eligibilityCOMCARE

Financial assistance for lower-income households. Hotline: 1800-222-0000.

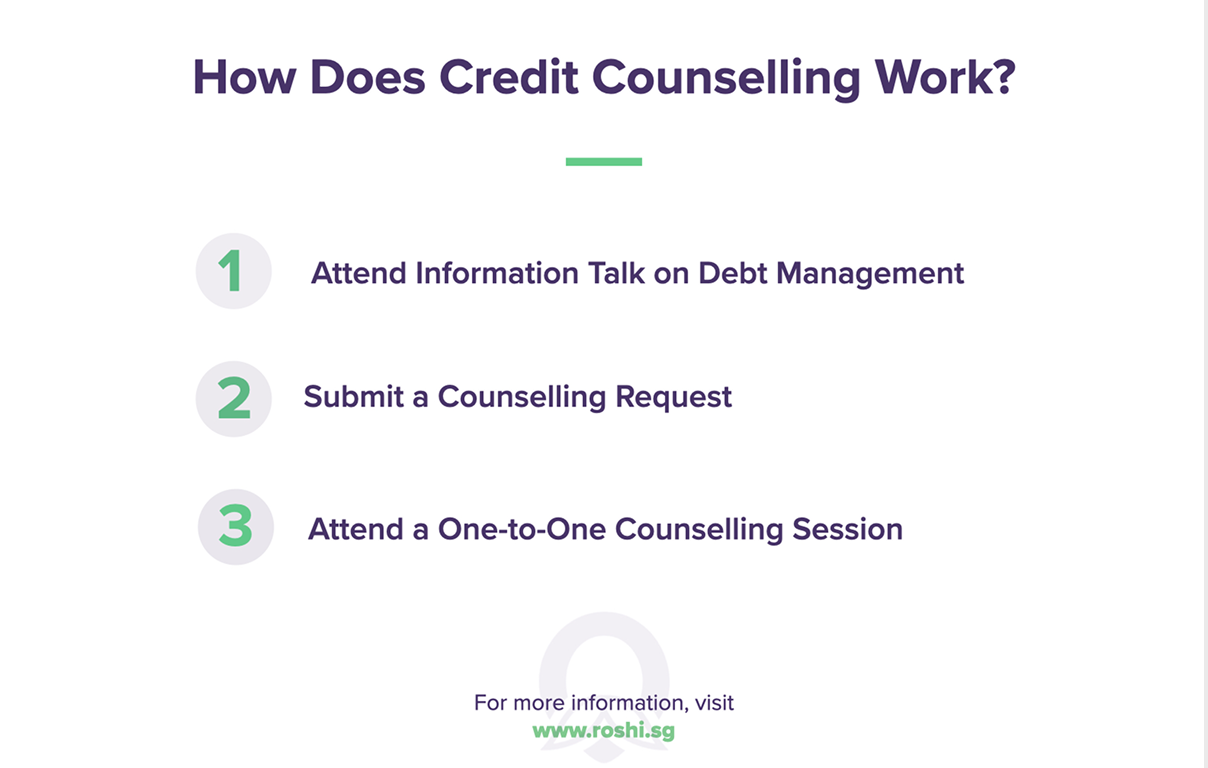

Learn moreCredit Counselling Singapore

Free advice on managing debt and finances. Hotline: 1800-225-5227.

Book appointment