Our Expert says

A low credit score doesn't define your financial future!

If your score dropped because of a rough patch, licensed moneylenders can still help. They assess your MLCB record, your current monthly income, your existing debt situation and your ability to make repayments.

Borrow what you can repay and use the loan to stabilise your financial situation at the same time avoid getting into recurring unmanageable debt.

Trinh Thanh

Head of Research

Get Approved with Bad Credit

How to Improve Your Approval Chances

- Show stable income with recent payslips or CPF statements

- Reduce existing debts before applying

- Borrow only an amount you can comfortably repay

- Bring complete documents to avoid approval delays

- Be honest about your financial situation, lenders check your MLCB report anyway

Rebuilding Your Credit Score

Rebuilding takes time but consistent effort pays off

- Pay all bills and loan on time, every month

- Keep credit card utilisation below 30% of your limit

- Avoid submitting multiple loan applications in a short period

- Check your CBS report regularly for errors

- Check your MLCB report to make sure your moneylender repayments are recorded correctly

- Set up auto payments wherever possible

- Close unused credit lines you no longer need

With consistent on-time payments most borrowers see improvement within 6–12 months.

Interest Rate Trends

Below is an overview of current interest rate trends in Singapore:

Today's moneylender interest rate trends in Singapore

Today's moneylender interest rate trends in Singapore - As of 9 March 2026, licensed moneylenders are charging an average interest rate of approximately

3.98% per month just under the legal cap of 4%.

Monthly Interest Rate Trends (March 2026)

Research updated by Trinh Thanh on 4 March 2026 - In March 2026, Singapore’s bad credit loan segment continues to operate within a measured and regulated lending landscape. No policy adjustments have been introduced to interest rate caps or fee limits and pricing structures remain anchored by statutory controls. Borrower activity in this category remains consistent, largely driven by short-term financial pressures rather than discretionary borrowing.

Unlike prime lending segments, bad credit loans are shaped less by promotional competition and more by individual risk assessment. Lenders continue to prioritise income stability and repayment capacity over historical credit performance alone. Market conditions in March show continuity from the previous month with no broad tightening or easing trends observed in approval patterns.

Unlike prime lending segments, bad credit loans are shaped less by promotional competition and more by individual risk assessment. Lenders continue to prioritise income stability and repayment capacity over historical credit performance alone. Market conditions in March show continuity from the previous month with no broad tightening or easing trends observed in approval patterns.

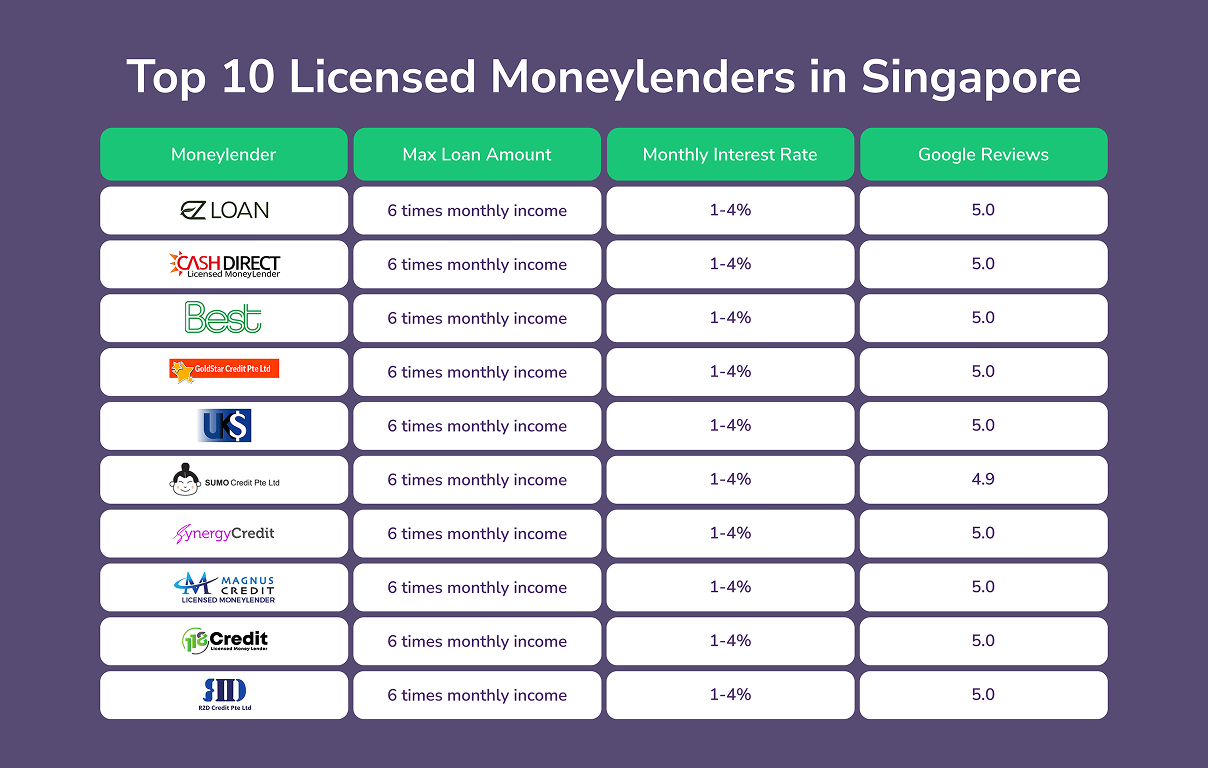

Licensed Moneylenders

As of March 2026, licensed moneylenders regulated by the Registry of Moneylenders under Singapore’s Ministry of Law remain the principal avenue for borrowers with impaired or limited credit histories. Average applied monthly interest rates continue to be around 3.8%, remaining just below the statutory ceiling of 4% per month. These rates reflect regulated boundaries rather than ad hoc pricing, even for higher-risk profiles.

Although borrowers may technically qualify for up to six times their monthly income, approval outcomes are primarily determined by present income consistency and overall affordability. Administrative fees remain capped at 10% of the principal, while late payment charges generally do not exceed S$60 per month. Applications are often initiated online for efficiency but Ministry of Law requirements mandate that identity verification and contract acknowledgement be completed in person at a licensed outlet prior to disbursement. Even with this procedural step, turnaround times remain relatively prompt, preserving access for borrowers who may not meet conventional bank criteria.

Although borrowers may technically qualify for up to six times their monthly income, approval outcomes are primarily determined by present income consistency and overall affordability. Administrative fees remain capped at 10% of the principal, while late payment charges generally do not exceed S$60 per month. Applications are often initiated online for efficiency but Ministry of Law requirements mandate that identity verification and contract acknowledgement be completed in person at a licensed outlet prior to disbursement. Even with this procedural step, turnaround times remain relatively prompt, preserving access for borrowers who may not meet conventional bank criteria.

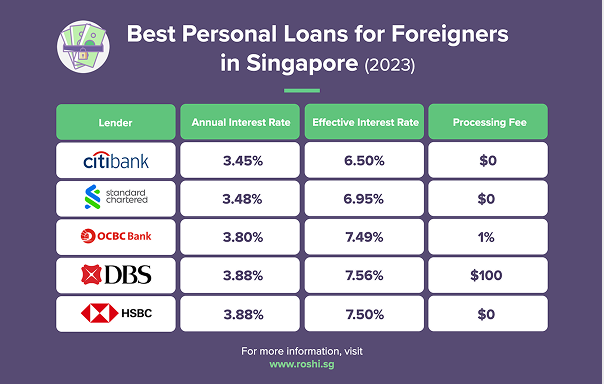

Banks

Traditional banks in Singapore continue to apply stringent credit evaluation standards, which significantly limits access for individuals with adverse credit records. While personal loans offered by banks carry lower Effective Interest Rates, eligibility typically depends on a stable repayment history and stronger credit scores.

For borrowers with weaker profiles, approval rates remain comparatively low and alternative arrangements such as secured facilities or guarantor-supported applications may be necessary. Processing timelines and documentation requirements further reduce practicality for those seeking immediate assistance. Consequently, banks maintain only a limited presence in the bad credit loan segment, particularly for short-term or urgent funding needs.

For borrowers with weaker profiles, approval rates remain comparatively low and alternative arrangements such as secured facilities or guarantor-supported applications may be necessary. Processing timelines and documentation requirements further reduce practicality for those seeking immediate assistance. Consequently, banks maintain only a limited presence in the bad credit loan segment, particularly for short-term or urgent funding needs.

ROSHI Expert Insight

In March 2026, the bad credit lending space continues to underscore the importance of structured regulation and transparent assessment. Licensed moneylenders remain open to evaluating applications from borrowers with prior credit challenges, provided income sufficiency and repayment capacity are demonstrated. Monthly interest levels near 3.8% reflect the regulated ceiling rather than unpredictable risk premiums.

From ROSHI’s standpoint, bad credit loans should be approached as transitional instruments rather than ongoing credit solutions. When structured responsibly and repaid according to schedule, they can serve as a bridge during temporary financial strain while allowing borrowers to stabilise their credit standing over time. Access through a licensed network ensures compliance with statutory safeguards and clear disclosure standards.

From ROSHI’s standpoint, bad credit loans should be approached as transitional instruments rather than ongoing credit solutions. When structured responsibly and repaid according to schedule, they can serve as a bridge during temporary financial strain while allowing borrowers to stabilise their credit standing over time. Access through a licensed network ensures compliance with statutory safeguards and clear disclosure standards.

What This Means for Borrowers

For March 2026, borrowers with imperfect credit histories will find that regulated options remain available, though careful evaluation is essential. Licensed moneylenders continue to provide an accessible pathway within defined legal limits on interest and fees, supported by mandatory disclosure and in‑person verification procedures that enhance transparency.

While borrowing costs are higher relative to bank loans, the structured framework helps prevent excessive charges and unclear terms. Borrowers who align loan amounts with realistic repayment capacity are better positioned to avoid compounding financial strain. By engaging reputable platforms such as ROSHI, individuals with weaker credit profiles can review licensed options confidently and make informed decisions that support both immediate needs and longer-term financial recovery.

While borrowing costs are higher relative to bank loans, the structured framework helps prevent excessive charges and unclear terms. Borrowers who align loan amounts with realistic repayment capacity are better positioned to avoid compounding financial strain. By engaging reputable platforms such as ROSHI, individuals with weaker credit profiles can review licensed options confidently and make informed decisions that support both immediate needs and longer-term financial recovery.