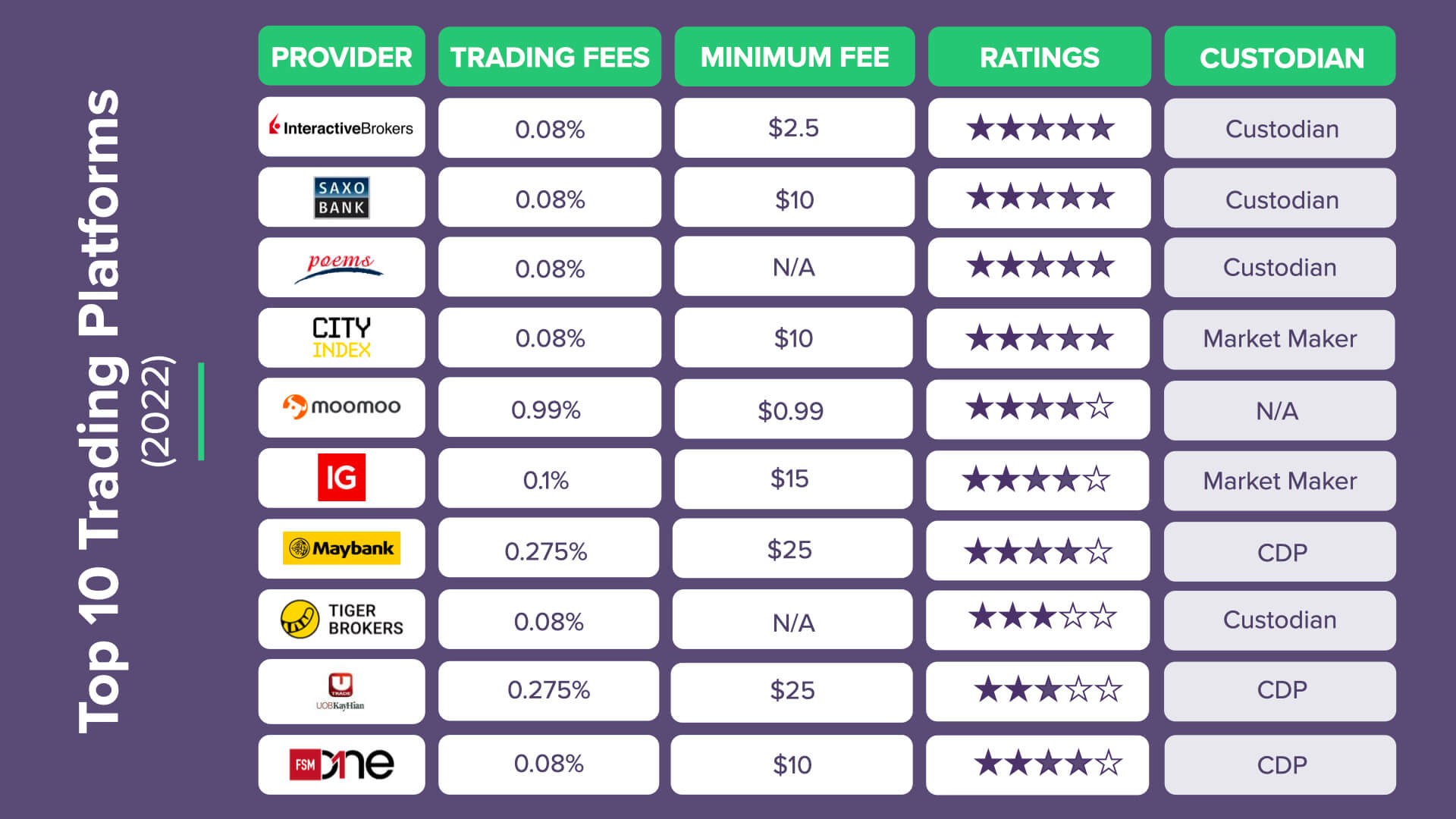

At a glance...

It’s never too late to start investing. Whether you’re in your early twenties trying to figure out how ‘adulting’ works, or mid-career and looking for ways to make your savings work for you, investing is for you!

Still, we know that it can be pretty daunting when you’re just starting out because there’s a myriad of different trading platforms, or brokers. That’s why we’ve put together this list of the top 10 online brokers in Singapore to help you narrow down your options and start right.

Interactive Brokers

Interactive Brokers (IBKR) is one of the most popular trading platform in Singapore. Many Singaporean investors were already using it before it opened a local office in July 2020. It is a well-known brokerage and has been listed on NASDAQ since 2007.

Interactive Brokers

0.08% Trading Fee (≺S$50k)

$2.5 Minimum Fee

Custodian Stock Holding Type

- Best overall brokerage platform.

- Invest globally in stocks, options, futures, currencies, bonds and funds.

- Transparent, low commissions and financing rates.

If you’re a Singaporean using it here, you’ll need to register as an IBKR Pro user. While the pricing is slightly different compared to IBKR Lite, you’ll have exclusive access to the entire array of IBKR’s features, including their advanced algorithms, APIs and tools. You’ll also be able to trade over 40 ETFs with zero transaction fees, under some T&Cs.

Features:

- No minimum deposit required

- Web and mobile platforms available for added flexibility

- Conveniently invest in 10 product types across 135 markets

Saxo Markets

Of all the trading platforms on this list, Saxo Markets takes the cake for being the most all-rounded. It offers trading of stocks and bonds, but it doesn’t stop there – users can also access advanced products like forex, CFDs and other financial products that work on a leverage-based system. Unlike most other platforms, they even offer savings plans and managed portfolios, which might appeal to those looking for a more passive investment regime.

Saxo Markets

0.08% Trading Fee (≺S$50k)

$10 Minimum Fee

Custodian Stock Holding Type

- One of the leading brokerage platforms in the market.

- Over 125,000 trades placed per day.

As the cherry on top of the cake, they also offer a bunch of educational resources on their learning hub to guide you along as you learn to invest.

Highlights to note:

- Inspiring educational content

- Mix of leverage trading, standard investment products including saving plans and managed portfolios

- Great selection of managed portfolio partners

POEMS

POEMS is another platform that has won its spot on this list through its hard-earned history of global recognition. It was established more than 40 years ago and offers a staggering variety of over 40,000 financial products in 15 different markets, which of course includes the US, Hong Kong, UK, Japan and Australia.

POEMS

0.08% Trading Fee (≺S$50k)

N/A Minimum Fee

Custodian Stock Holding Type

- Receive up to S$88* CFD trade rebates.

- Transfer-In & receive up to S$1,000* when you transfer your unit trust.

An added perk is that you have the option to fund your account through multiple methods, most of which do not charge service fees.

Overall, POEMS is trustworthy and ideal for investors and traders who are looking to cast their nets wide and deal in many different product types.

Features:

- Many educational resources including video tutorials, articles, events and webinars

- Range of investments including regular saving plans and CPF SRS Investment

- Competitive brokerage commission

City Index

City Index makes the top 10 list for its strong global presence and relatively long history of establishment. Founded in 1983 as the trading brand of GAIN Capital (which is listed on NYSE), City Index is an internationally renowned CFD and forex broker. It’s been approved by multiple financial authorities around the world, among which are the Monetary Authority of Singapore (MAS), the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Its many credentials make City Index a reputable and reliable platform for investing.

City Index

0.08% Trading Fee (≺S$50k)

$10 Minimum Fee

Market Maker Stock Holding Type

- Charts with 80+ indicators and tools for technical and fundamental trading.

- Trade CFDs on thousands of global markets and enjoy competitive pricing.

Their current sign-up promo offers one year of all-access membership to the Wall Street Journal (worth S$480) when you create an account and make a deposit of at least S$6,500.

Highlights to note:

- No deposit fees (bank transfers, FAST and PayNow)

- Content hub for market research and investment education

- Over 4,500 CFDs on offer including equity and cryptocurrencies

moomoo (by Futu SG)

“Download moomoo now!” Even before you seriously thought about investing, you might have already come across its ads on YouTube or in MRT stations. moomoo by FUTU SG is among our top picks because of how easy it is to use and its attractive sign-up bonuses.

During its launch, it offered new users a free AAPL share, but don’t worry, you haven’t missed out! It currently still has a rotation of different freebies (think free shares and/or cashback) for new registrations. Check out the website for the latest promotions (T&Cs apply).

moomoo (by Futu SG)

0.99% Trading Fee (≺S$50k)

$0.99 Minimum Fee

N/A Stock Holding Type

- Wide Array of Investment Choices

- Flexible Global Asset Allocation

- Trade Blue-Chip Stocks in US, HK and SG Markets

With its handy mobile app, you can easily compare different stocks and filter by market cap, percentage change, turnover, trade volume and other parameters. The platform offers a relatively low commission fee of US$0.99 for US stocks, HK$3 for HK stocks and S$0.99 for SG stocks.

Features:

- No minimum deposit required

- Attractive sign-up promotions

- Low minimum commission fee (US$0.99 for US stocks, HK$3 for HK stocks and S$0.99 for SG stocks)

IG

Another star-studded platform that’s well-known worldwide is IG, a platform that’s been around for more than 45 years. It’s listed on the London Stock Exchange, approved by regulators from a few of the top jurisdictions in the world, and has even pocketed a couple of awards for its mobile app.

IG

0.1% Trading Fee (≺S$50k)

$15 Minimum Fee

Market Maker Stock Holding Type

- Flexible access to more than 17,000 global markets, with reliable execution.

- Trade on the move with natively designed, award-winning trading app.

IG offers one of the largest pools of CFDs and forex trades, with access to more than 17,000 markets and 104 forex pairs. Beginners, don’t be intimidated by this: apart from its extremely user-friendly trading platform, it also offers a suite of free online courses and webinars with its very own IG Academy.

Features:

- Access to more than 17,000 markets worldwide

- Award-winning mobile app

- Stock research and eductional tools

Maybank Kim Eng

This name might be slightly more familiar to some of us. Maybank Kim Eng is Maybank’s investment arm and caters to a range of investing types, allowing its users to build up well-diversified portfolios. It offers a mix of leveraged and non-leveraged products for trade, including stocks, shares, bonds, ETFs, forex and CFDs. It can also be an ideal platform for investors looking to try a bit of everything.

Maybank Kim Eng

0.275% Trading Fee (≺S$50k)

$25 Minimum Fee

CDP Stock Holding Type

- Oldest stockbroker in Singapore.

Highlights to note:

- Wide variety of trading instruments

- Updated stock news and market insights

- No inactivity fees for dormant accounts

Tiger Brokers

Tiger Brokers has both credentials and low commission fees to make it a reliable platform for anyone just starting out. The platform is supported by Xiaomi and listed on NASDAQ. Apart from the Singapore market, it also provides easy access to global markets such as USA, Hong Kong, China and Australia. Enjoy your pick of ETFs, REITs, futures, options, warrants, CBBCs and other financial products across multiple markets, all from just one account.

Tiger Brokers

0.08% Trading Fee (≺S$50k)

N/A Minimum Fee

Custodian Stock Holding Type

- No min. deposit required.

- No min. commission, inactivity, or custodian fees

- No limits on the number of trades.

Highlights to note:

- Sign-up can be expedited using SingPass MyInfo

- Access stocks, ETFs, warrants, options, REITs, futures from various markets conveniently from your account

- No minimum deposit required

UOB Kay Hian

We couldn’t just leave out the largest broker in Singapore, because that’s what UOB Kay Hian is. This broker is tailored to the local economy and focuses on just a small pool of stock markets: Singapore, Malaysia, Hong Kong and the US. Still, it offers many types of investments, such as ETFs, bonds, UTs, CFDs and forex. As the name implies, it’s supported by UOB, so you can rest assured that it’s a safe and trustworthy place to start out.

UOB Kay Hian UTRADE

- No custodian fee and no hidden cost such as platform fees.

Features:

- 7 markets available to trade

- Lower commission fees for Cash Upfront accounts

- PayNow enabled for instant trade funding

FSMOne Fundsupermart

Amidst the many beginner-friendly trading platforms, we’d say FSMOne Fundsupermart is one that is not for the faint of heart. This platform is best suited for experienced traders and investors who have been at it for some time and know which types of investing they’d prefer to focus on. Its heavy focus on educational materials, high quality research and well-curated news help traders who’ve found their niche truly blossom by increasing their chances of success. The resources include news headlines, in-house content and premium resources from leading think-tanks.

FSMOne Fundsupermart

0.08% Trading Fee (≺S$50k)

$10 Minimum Fee

CDP Stock Holding Type

- Access to global & local unit trusts, mutual funds and bonds.

- Trade Singapore, Hong Kong and U.S. stocks

Permanent 0% sales charge on all funds and managed portfolios for all clients.

Choose from over 1,723 Unit Trusts at 0% Sales.

Highlights to note:

- Zero sales charge on all funds and managed portfolios

- Choose from over 1,723 unit trusts at 0% sales

Insider tip

Beginners who are eager to learn and up for a challenge will also reap returns from the generous sharing of knowledge available through your account.