At a Glance

Looking for fast cash? Singapore’s licensed moneylenders are a much better alternative than borrowing from a friend or relative. Clear terms, manageable repayment plans and competitive interest rates give you financial flexibility. We will guide you through important factors to consider when choosing a moneylender in this article and point out the top 10 reputable moneylenders in Singapore. Continue reading to make a proper decision on your personal loan.

Process of Choosing the Best Personal Loan Moneylenders

Choosing the right moneylender for your needs can be a challenging task. Here are the key factors to consider when making your decision:

- License and Accreditation

It’s essential to work with a moneylender licensed by the Singapore government. Licensed lenders comply with legal standards, ensuring that their services are trustworthy and regulated. Accreditation from professional organizations is another sign of reliability, as it indicates the lender adheres to high industry standards.

- Terms and Conditions

The terms and conditions provided by the licensed moneylender form the basis of your loan contract. This comprises the amount borrowed, interest rates, repayment plans and penalties. Always work with a lender whose terms suit your budget and ensure that you know and understand all of the conditions contained before you put your signature on anything.

- Fees

Licensed moneylenders charge fees for their services. These may include processing fees, late payment penalties or administrative charges. Compare the fee structures of different lenders to find one that offers competitive rates without hidden costs.

- Reputation

The reputation of a moneylender is an important consideration. Look for reviews and testimonials from previous borrowers to gauge their experiences. Opt for a moneylender with positive feedback and a history of good customer service.

- Comparison

Before settling on a moneylender, compare multiple options. By exploring a variety of lenders, you’ll increase your chances of finding the best terms, rates and services.

How much can I borrow from a licensed money lender?

For unsecured loans, this is how much you can borrow:

| Borrower’s Annual Income | Singapore Citizens and Permanent Residents | Foreigners Residing in Singapore |

|---|---|---|

| Less than $10,000 | $3,000 | $500 |

| At least $10,000 and less than $20,000 | $3,000 | $3,000 |

| At least $20,000 | 6 times monthly income | 6 times monthly income |

What Are the Warning Signs of an Unlicensed Moneylender?

Even if a moneylender seems legitimate on the surface, there are several red flags that could indicate they are operating illegally. It is essential to remain vigilant and cautious to protect yourself from potential scams or exploitative practices. Watch out for warning signs, such as:

- Use abusive language or threats during communication.

- Request your SingPass login credentials.

- Retain your NRIC or personal documents, such as a work permit or passport.

- Ask you to sign blank or incomplete contracts.

- Provide a loan without offering a copy of the contract or explaining the terms.

- Approve a loan without proper due diligence, such as verifying your application and documents.

- Withhold part of the loan amount without a valid reason.

If you encounter such practices, report the lender to the Registry of Moneylenders with details of their business name, license number and contact information.

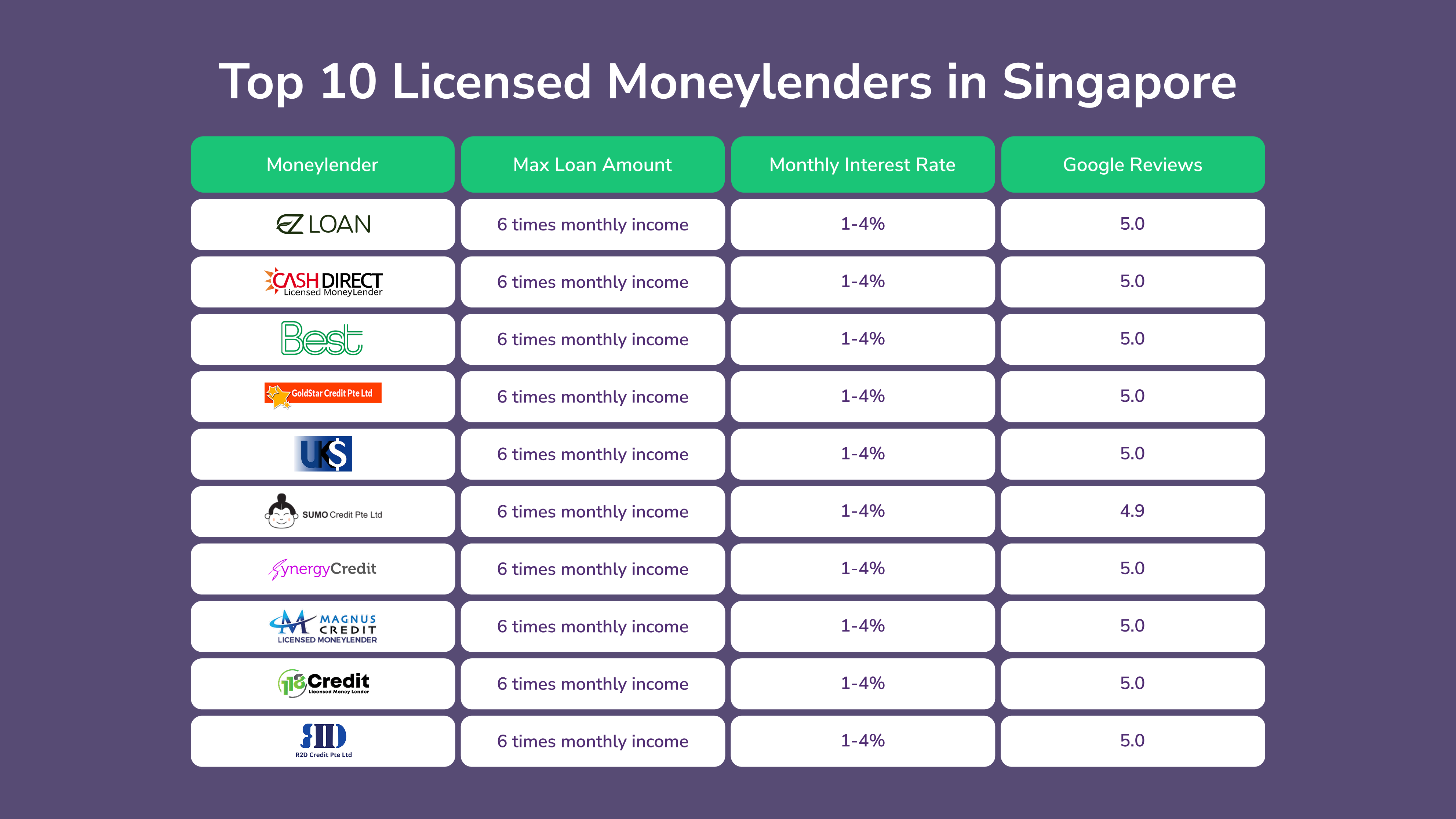

Our Top 10 Picks for the Most Reputable Moneylenders

After careful evaluation, we’ve identified a list of moneylenders known for their exceptional service, transparency and value for borrowers. These providers stand out for offering competitive rates, flexible terms and a reliable borrowing experience. Here are the top choices:

1. EZ Loan

EZ Loan

EZ Loan is a trusted licensed moneylender in Singapore, known for its quick and efficient financial services. Borrowers can secure loans of up to six times their monthly income, whether they are Singaporeans, Permanent Residents or foreigners with valid employment passes. Offering a monthly interest rate between 1% and 4%, EZ Loan ensures affordability while meeting diverse financial needs.

The application process is simple and efficient, utilizing a secure online system integrated with SingPass for fast verification. Borrowers need to provide basic documents, including proof of income, identification and employment details, to complete their applications.

With its focus on transparent terms, competitive rates and flexible repayment plans, EZ Loan is an excellent option for individuals seeking reliable financial assistance. Its seamless application process and customer-centric approach make it a standout choice among licensed moneylenders in Singapore.

2. Cash Direct

Cash Direct

Cash Direct is a popular licensed moneylender in Singapore, backed by a team of highly qualified professionals and commitment to premium service. Borrowers can secure loans of up to six times their monthly income, whether they are Singaporeans, PR’s or foreigners with valid employment passes. Offering monthly interest rates ranging from 1% and 4%, Cash Direct offers affordable rates while servicing different financial needs.

The application process is super simple and convenient. Their loan officers hold qualifications from the Credit Association of Singapore, including Prevention of Money Laundering and Financing of Terrorism certification and undergo continuing professional development training every quarter to maintain the highest standards of service.

Cash Direct focuses on transparent terms, competitive rates and a smooth loan application process. This licensed moneylender is an excellent option for individuals seeking reliable financial assistance. The company’s commitment to privacy, professional excellence and their customer-centric approach makes it a standout choice among licensed moneylenders in Singapore.

3. Best Licensed Moneylender

Best Licensed Moneylender

Best Licensed Moneylender is among the top-rated financial providers, noted continually for its great efficiency in service and competitive terms. It lends up to six times the monthly income of the borrower, whether Singaporean, Permanent Residents or even foreigners. This lender guarantees affordability and flexibility to cover a variety of financial needs with monthly interest ranging from 1% to 4%.

The application process is pretty simple and safe, due to the user-friendly online platform. It assists borrowers in uploading any required documents, such as proof of income or identification, easily in order to complete their applications without hassle. This streamlined approach minimizes paperwork while ensuring fast approvals.

With transparent fees and a focus on secure transactions, Best Licensed Moneylender truly combines convenience with reliability. Its reputation as a trusted provider makes it a top choice for those seeking tailored financial solutions in Singapore.

4. Goldstar Credit

Goldstar Credit

Goldstar is a licensed moneylender in Singapore with a friendly team that offers personalized financial advice to help borrowers manage their everyday debt challenges. Each team member is a trained and certified professional, ensuring clients receive empathetic support tailored to their unique financial circumstances. Goldstar Credit focuses on creating customised repayment plans that fit each borrower’s specific situation and financial capacity.

The application process is straightforward, supported by experienced professionals including senior loan officers and debt collection executives with 10 years of experience in their respective fields. All loan officers are diploma holders, certified in Prevention of Money Laundering and Financing of Terrorism and hold Money Lender Operations & Compliance Training certification from the Credit Association of Singapore.

The lender’s mission is to become Singapore’s preferred licensed moneylender through specially designed repayment solutions. The company aims to reduce financial stress for clients while maintaining exceptional customer service standards. With their commitment to helping each and every borrower through personalized loan plans, Goldstar strives to establish itself as Singapore’s most reliable licensed moneylender.

5. UK Credit

UK Credit

UK Credit has been assisting borrowers in the Bedok area and beyond since 2012. Since then they have helped over 11,000 Singaporeans to manage difficult financial situations. What makes this reputable and licensed moneylender stand out is their focus on speed, borrowers can get loans confirmed and money disbursed in as little as 20 minutes through their efficient cashless transfer setup.

The UK Credit team has over 20 years of combined experience in managing professional and legal money lending services. Borrowers get comprehensive financial guidance and debt management advice, helping each and every borrower to make informed decisions rather than just pushing loans. Also the moneylenders’ flexible repayment options cater to different personal financial situations.

Conveniently located near Bedok MRT and bus interchange their location makes it accessible for both local or islandwide borrowers. UK’s Credit central location in the heart of Bedok makes it a practical choice for east side residents who need reliable and fast financial assistance without the hassle of traveling across SIngapore.

6. Sumo Credit

Sumo Credit

Sumo Credit has been in the market for over 14 years and have established themselves as a reliable licensed moneylender in the Serangoon area. Applications can be submitted online which is super convenient for borrowers. Their team genuinely cares about helping borrowers, whether covering unexpected medical bills or other daily expenses. They even offer financing support for foreign workers.

Borrowers can complete loan applications in under 15 minutes. Their consultants handle decisions quickly so you’re not left waiting and worrying. Once approved, you’ll just need to come by their office near Serangoon MRT for a quick face-to-face interview and verification. They offer competitive rates at around 2-4% monthly and can lend up to 6 times your monthly income.

Sumo Credits commitment to transparency and respect throughout the entire process is really what sets them apart from other moneylenders. Their consultants take time to explain loan details in a language anyone can understand, ensuring there are no hidden surprises later on. With a solid 4.9-star rating from over 900 customers on Google, they’ve proven themselves as a trustworthy licensed moneylender in Singapore. Their location just 400 meters from Serangoon MRT makes them incredibly convenient for anyone in the northeast side of town.

7. Synergy Credit

Synergy Credit

Since 2009 Synergy Credit has established itself as a popular moneylender among borrowers in Singapore. They offer customisable lending solutions, ensuring that borrowers from all walks of life receive the financial assistance they need regardless of the circumstances. They offer comprehensive financing options for various purposes including covering personal or business expenses, business ventures, debt consolidation and many more, all while maintaining their commitment to fair practices regardless of borrower credit history.

What sets Synergy Credit apart is their philosophy of non-discriminatory lending, which has enabled them to build strong relationships with customers who consistently rate them as one of the top licensed moneylenders in Clementi. Their team of loan officers understands that every borrower’s situation is unique, which is why they specialize in personalised loan options to meet different financial requirements while providing transparent guidance on avoiding scams and illegal lending practices.

Their website makes the application process super easy so borrowers experience fast decisions without hidden fees or unnecessary delays. Their commitment to better customer experience is strengthened through their partnership with ROSHI, Singapore’s leading AI-driven loan comparison platform.

As a licensed moneylender registered with Singapore’s Ministry of Law and endorsed by the Singapore FinTech Association as a certified FinTech Company, Synergy Credit offers borrowers a great borrowing experience. Their competitive rates, flexible repayment terms and paperless loan solutions demonstrate their dedication to delivering secure and inclusive financial services. The company’s mission remains clear: to be the preferred financial partner by providing regulated solutions that help customers achieve their personal and business goals through ethical financial practices and great customer service.

8. Magnus Credit

Magnus Credit

Magnus Credit has been supporting borrowers in Singapore since 2009, building a solid reputation as a trusted licensed moneylender that truly understands financial needs of its customers. What sets Magnus apart is their commitment to same day loan approvals. Their team of friendly consultants takes the time to understand your specific situation, whether you’re dealing with unexpected medical bills, home repairs or just need some breathing room between paydays.

The application process is super simple, borrowers can submit loan applications online and their team will work quickly to assess and review details. Once approved, you just need to visit their office to complete the paperwork and you’ll walk out with cash in hand within minutes. They offer various loan types including personal loans, payday loans and even specialized options for foreigners working in Singapore.

Magnus Credit’s 15+ years in the industry speaks to their reliability and commitment to ethical lending practices. They prioritize borrowers’ privacy and ensure all personal information remains strictly confidential.. Their business philosophy centers on providing convenient, hassle-free financial solutions with competitive rates.

9. 118 Credit

118 Credit

118 Credit has been serving Singaporean borrowers since 2010 and earned a reputation as a reliable licensed moneylender. Their team has a great understanding of financial needs whether medical bills, home repairs or other financial emergencies due to other personal reasons. They’ve designed their entire system around eliminating the anxiety ridden loan application process with no endless paperwork or waiting periods that leave borrowers wondering if they can get approved or not.

118 Credit’s experienced lending team streamlines the entire loan buying process with the goal to make it quick and transparent. They assist Singaporean residents, local business owners and even foreign workers all with the same level of personalised attention. They also offer flexible repayment tenures based on specific payday schedules.

This licensed moneylender operates under full compliance with Singapore’s Moneylenders Act and Registry of Moneylenders regulations and with over a decade of experience helping Singaporeans through financial challenges, they’ve established themselves as a dependable lender who offers financial assistance for its customers.

10. R2D Credit

R2D Credit

R2D Credit has carved out a niche in Singapore’s lending landscape by focusing on helping borrowers become debt-free rather than just providing quick cash. Located in Yishun and just a one-minute walk from the MRT station, they’ve made themselves accessible to anyone across Singapore through excellent public transport connections. What sets them apart is their commitment to their customers financial health, offering flexible repayment plans where borrowers can customize repayment dates to match actual cash flow.

Their application process is designed with convenience, borrowers can apply online 24/7 without having to take time off work or rearrange their schedules. They’ve even integrated Singpass MyInfo applications, making the whole process more secure and super fast. R2D Credit also offers fast approvals even for customers with bad credit, understanding that everyone deserves a second chance when facing financial difficulties.

R2D Credit’s philosophy goes beyond moneylending, they see themselves as partners in its customers journey toward financial stability rather than just another lender looking to profit. Their experienced team uses their knowledge to guide borrowers toward becoming debt-free as quickly as possible, rather than keeping them in a cycle of borrowing.

Overview of Moneylenders

| Moneylender | Max. Loan Amount (Singaporeans) | Max. Loan Amount (Foreigners) | Monthly Interest Rate |

|---|---|---|---|

| No data found | |||

Considerations

While avoiding debt is always ideal, sometimes taking a loan is necessary. If you decide to borrow, choosing the right moneylender is just as important as ensuring timely repayments to avoid unnecessary fees. Beyond borrowing, maintaining healthy financial habits is key, regularly review of your budget, expenses tracking and setting aside savings to reduce reliance on loans.

Building an emergency fund with a few months’ worth of expenses can also provide a safety net, offering an alternative to borrowing in tough times. Additionally having the right insurance coverage can help manage unexpected financial emergencies, reducing the need for cash loans. By staying informed and making smart financial choices, you can navigate borrowing responsibly and secure a stable financial future.