At A Glance

Business term loans in Singapore present a stable financing option with predictable monthly payments and competitive interest rates. These loans are created to meet different business needs, including expansion, managing working capital or purchasing new equipment. In Singapore, businesses can explore financing from established banks such as DBS, OCBC and Maybank, as well as alternative digital lenders like Anext and Orix. Each provider offers unique loan structures suited for SMEs, startups and growing enterprises with distinct capital requirements. This guide outlines and compares the main features of five prominent lenders. It highlights differences in interest rates, administrative fees and repayment terms, making it easier to identify the financing solution that best fits your growth plans and daily operations.

Business Loan Options in Singapore: Key Concepts You Should Know

Before we dive into the top business term loans available in Singapore, it’s essential to understand the foundational types of financing available to enterprises. Whether you’re running a startup or scaling an established SME, knowing which loan type fits your needs will help you make informed and strategic funding decisions.

Below are the most common business loan categories in Singapore, each serving distinct purposes based on your company’s stage, cash flow requirements and risk profile.

1. Standard Business Term Loan

This type of loan is generally unsecured, meaning companies are not required to pledge assets such as property or equipment as collateral. Borrowers receive a lump sum at the start and repay the amount in equal monthly installments, typically over a period of up to five years.

These loans are commonly available from major commercial banks including DBS, OCBC and Maybank. They are well-suited for various business purposes like purchasing inventory, renovating premises or managing short-term cash flow. With fixed repayment amounts, businesses gain the advantage of consistent budgeting and easier financial planning.

2. SME Working Capital Loan (WCL)

Supported by Enterprise Singapore, the SME Working Capital Loan (WCL) is a government-backed financing initiative that helps locally owned small and medium-sized enterprises (SMEs) manage their operations and growth needs. Qualified businesses can secure up to S$1 million, with repayment terms ranging from one to five years.

To be eligible, a company must be registered in Singapore, maintain at least 30% local ownership and have an annual group revenue below S$500 million. Because the government shares loan risk with partnering financial institutions, WCL usually offers more favorable interest rates than standard commercial bank loans, making it a strong option for SMEs seeking stable working capital.

3. Temporary Bridging Loan Programme (TBLP)

Initially launched during the COVID-19 pandemic to help businesses navigate financial challenges, the Temporary Bridging Loan Programme (TBLP) continues to support qualifying local enterprises today. The scheme provides up to S$5 million in financing, with repayment periods extending up to five years.

Similar to WCL, eligibility requires at least 30% Singaporean or permanent resident ownership. Although primarily designed to support working capital requirements, companies also use TBLP funds to finance new product launches, capacity expansion and international ventures. With interest rates typically below market averages, TBLP remains a valuable short-term liquidity option for local businesses.

4. Startup Business Loan

For early-stage businesses or companies with a limited financial track record, traditional bank loans can be difficult to obtain. Startup business loans address this gap by offering accessible funding for new ventures. These loans usually provide up to S$100,000 in working capital for purposes such as inventory purchasing, marketing, equipment acquisition or initial hiring.

Instead of relying solely on corporate financial statements, lenders may evaluate your business plan, cash flow projections and personal credit standing to determine eligibility. Although loan amounts are smaller compared to conventional facilities, startup business loans play a critical role in driving entrepreneurship and supporting Singapore’s startup ecosystem.

5. Business Loans from Licensed Moneylenders

For companies that cannot obtain financing from banks due to limited credit history, weaker financial standing or urgent cash flow demands, licensed moneylenders in Singapore provide a viable alternative. These lenders operate under strict regulations set by the Ministry of Law, which enforces transparency in loan terms, fees and interest rate caps to protect borrowers.

The approval and disbursement process is notably faster, often completed within one or two days, with minimal paperwork required. Nevertheless, borrowers should note that interest rates and administrative fees are generally higher than those offered by banks. Conducting a thorough assessment of the repayment schedule and total cost is essential to ensure the loan structure fits your company’s cash flow capacity.

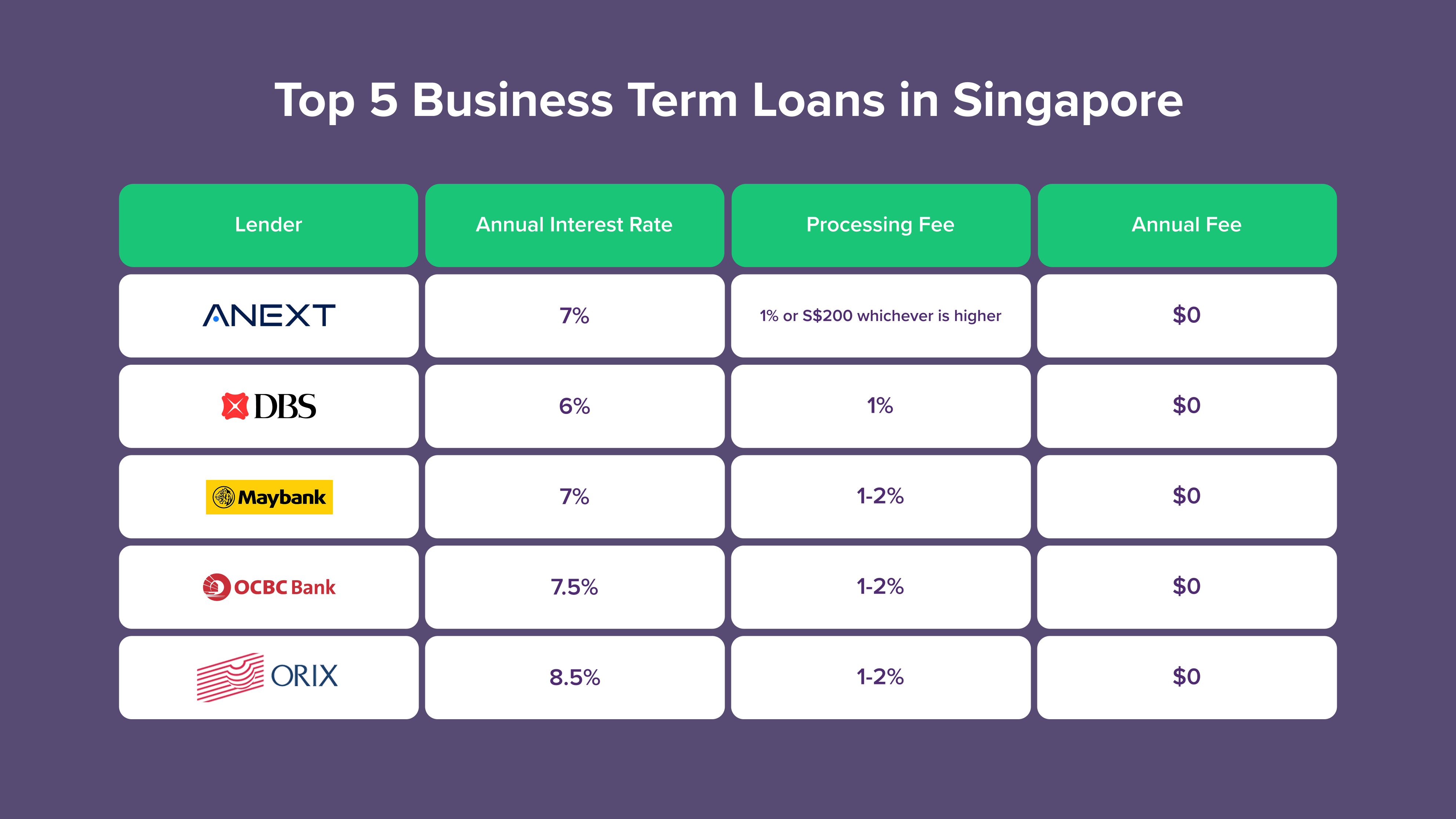

Top 5 Business Term Loans in Singapore

Business term loans are one of the most reliable financing options for companies in Singapore looking to fund expansion, manage operational costs or invest in infrastructure. With fixed interest rates and structured repayment terms, these loans offer businesses predictability and control over their financial planning. Below are five of the most competitive business term loan options available for companies operating in Singapore

1. ANEXT Business Term Loan

ANEXT, a MAS-regulated digital bank, provides a modern, accessible business term loan solution for companies looking for convenient and fast financing. With an annual interest rate of 7% and a processing fee of 1% or minimum S$200, this loan offers affordability with zero annual fees.

ANEXT Business Term Loan

Typical monthly repayments are around S$2,970.18, making it a manageable option for businesses seeking capital without complex collateral requirements. The digital-only onboarding process includes real-time application tracking and quicker disbursals than traditional banks.

2. DBS Business Term Loan

DBS offers one of the most cost-effective business term loans in the market, ideal for established companies in need of working capital or expansion funding. The loan features an annual interest rate of 6%, a 1% processing fee and no annual fee, keeping the overall cost competitive.

Monthly repayments average S$2,899.92, offering a sustainable financing structure. DBS also provides access to its integrated digital banking platform, along with cash flow analytics and dedicated loan advisory services.

3. Maybank Business Term Loan

Maybank’s business term loan is structured to serve a wide variety of corporate financing needs. With a fixed annual interest rate of 7% and a processing fee between 1% and 2%, it provides flexibility with transparent terms. No annual fees apply and monthly repayments are approximately S$2,970.18.

Maybank Business Term Loan

The bank’s SME and corporate banking arms offer personalized assistance throughout the loan process, ensuring faster approvals and tailored funding strategies.

4. OCBC Business Term Loan

OCBC offers an accessible term loan option with competitive rates and robust support infrastructure. The loan carries a 7.5% annual interest rate, 1%–2% processing fee and no annual fee, with monthly repayments around S$3,005.69.

OCBC Business Term Loan

OCBC enhances the lending experience with its digital tools, real-time dashboards and comprehensive financial insights. Businesses also benefit from loan structuring consultations and bundled financial services.

5. Orix Business Term Loan

Orix provides a premium business term loan solution with a focus on speed, flexibility and scalability. With an annual interest rate of 8.5% and a processing fee between 1% and 2%, the loan suits companies with more aggressive growth plans. There is no annual fee and monthly repayments are about S$3,077.48.

Orix Business Term Loan

The lender is known for its responsive service and fast disbursal, often outpacing traditional financial institutions. Loan packages are highly customizable, accommodating larger financing needs and complex business models.

Alternative Lending Options: P2P Lending for Business Growth

As traditional bank loans may not always align with the funding timeline or credit profile of startups and SMEs, alternative financing options like peer-to-peer (P2P) lending have emerged as flexible and accessible solutions. In Singapore, platforms such as Validus and Funding Societies are leading the way, offering business loans with fast processing, competitive interest rates and minimal collateral requirements. Below, we explore how each platform supports business term loan needs for emerging enterprises.

6. Validus P2P Lending

Validus is one of Singapore’s top peer-to-peer lending platforms, purpose-built to support SME growth through digital financing. Operating under a Monetary Authority of Singapore (MAS) license, Validus connects institutional and accredited investors directly with local businesses in need of funding. Its business term loan product is a popular choice among startups and growth-stage companies seeking fast access to working capital.

Validus P2P Lending

Validus offers an impressively low annual interest rate starting at 1.3%, which is significantly below traditional bank lending rates. The processing fee ranges from 2.5% to 5% and there is no annual fee, which helps reduce long-term financing costs. With a fixed monthly repayment of approximately S$2,583.48, businesses can better forecast and manage their cash flow.

The application process is fully digital, allowing for quick onboarding and approval. Borrowers benefit from a streamlined risk assessment system powered by real-time business data analytics. Unlike conventional banks, Validus does not strictly require extensive credit histories or physical collateral, making it especially useful for newly incorporated firms or those with limited credit access.

This lender is ideal for businesses looking to finance short-term operational needs, supplier payments or bridge seasonal cash flow gaps. With its SME-focused lending model and commitment to financial inclusion, Validus provides a robust alternative for companies aiming to scale efficiently in a competitive landscape.

7. Funding Societies P2P Lending

Funding Societies is one of Singapore’s leading peer-to-peer (P2P) lending platforms, well-known for offering agile and flexible financing solutions designed for small and medium-sized enterprises (SMEs). Supported by Sequoia Capital and active across Southeast Asia, the platform has disbursed more than S$3 billion in loans, positioning itself as a trusted alternative for businesses seeking non-bank funding with simplified eligibility criteria.

Funding Societies P2P Lending

The platform’s business term loan product features a competitive annual interest rate starting at 1.65%, with processing fees ranging from 3% to 8%. As with Validus, there are no annual maintenance fees, which helps businesses keep their financial overheads low. Borrowers typically repay about S$2,606.26 per month, a manageable amount for startups and expanding companies with moderate revenue levels.

Funding Societies distinguishes itself through its flexible loan quantum, simplified documentation process and quick fund release, often completed within 48 hours. Applications can be made online via its dedicated mobile app or web platform, where approval decisions rely on data-driven credit assessments and alternative scoring systems based on business performance.

This P2P platform is particularly suitable for SMEs that require immediate capital injections, equipment purchases or short-term project financing without the lengthy approval process associated with traditional banks. Furthermore, Funding Societies promotes borrower education and financial transparency, equipping business owners with the knowledge to make informed borrowing decisions.

For startups and young enterprises navigating early growth stages, Funding Societies offers a modern, technology-driven financing option that aligns with the fast-paced nature of today’s digital economy.

Latest Business Term Loan Rates

The following overview presents current business term loan rates from Singapore banks and alternative lenders. The data encompasses various loan sizes, maturity periods and lending criteria specifically designed for established businesses requiring funding for equipment purchases, facility expansion or major operational investments.

Consideration

When selecting a business term loan in Singapore, it’s important to evaluate more than just the interest rate. Start by assessing the total cost of borrowing, which includes not only the rate itself but also processing fees, administrative charges and early repayment penalties. Equally important is understanding your monthly repayment amount and ensuring that your business maintains a consistent cash flow to meet those obligations.

Loan eligibility requirements differ among financial institutions. Traditional banks such as DBS and OCBC often expect a strong credit history and longer business track records, whereas digital lenders like Anext tend to be more flexible and accommodating toward startups and SMEs. Another factor worth reviewing is the approval speed, since certain lenders provide online onboarding and rapid disbursement, which can be crucial when funding is needed quickly.

You should also evaluate the available loan tenures and determine whether the lender allows customized repayment schedules tailored to your business’s financial cycle. Opting for a provider with a transparent fee policy and reliable customer support can greatly enhance your financing experience. Ultimately, aligning your loan structure with your company’s growth strategy helps ensure long-term financial stability and sustainable operations.