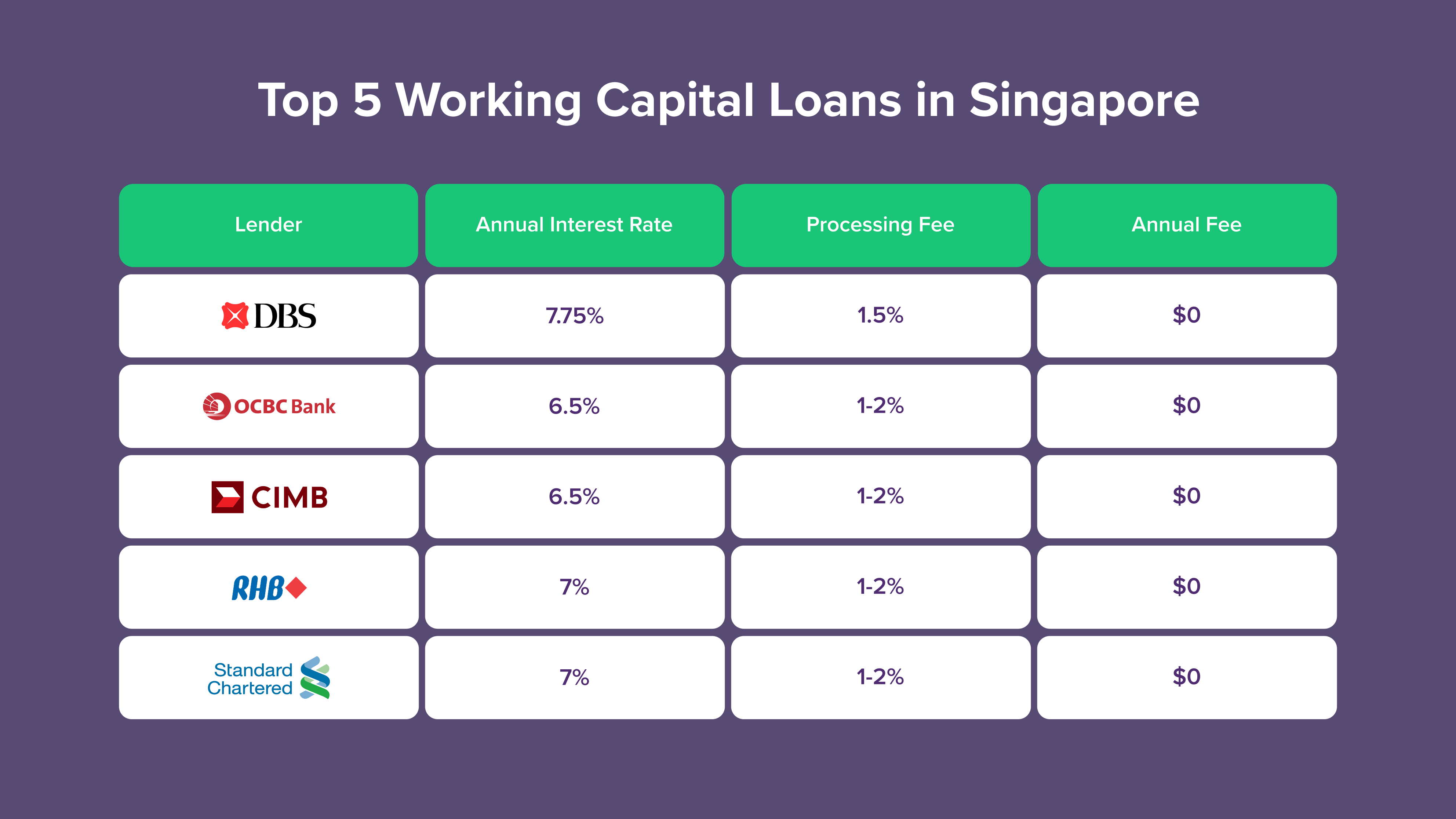

At a glance

Need extra capital to manage your daily business operations? Working capital loans from Singapore’s leading banks provide a structured and low‑risk solution designed specifically for small and medium‑sized enterprises (SMEs). Whether your goal is to bridge cash‑flow shortages, replenish inventory or cover payroll expenses, banks such as DBS, OCBC, CIMB, RHB and Standard Chartered Bank (SCB) offer accessible financing with competitive interest rates and flexible repayment options to support your business continuity.

Unlike informal borrowing or short‑term credit card financing, these loans promote transparency, ensure predictable repayment schedules and enable smarter financial planning. They are well‑suited for businesses seeking stability and structured cash‑flow management without taking on unnecessary credit risks.

In this guide, we highlight the key features of five major banks in Singapore, allowing you to compare interest rates, loan tenures and eligibility conditions side by side. By understanding the unique advantages of each provider, you can make an informed decision that aligns with your business objectives, cash‑flow cycles and growth strategies, ensuring your enterprise continues to operate smoothly and sustainably.

Business Loan Types Every SME in Singapore Should Know

Before we dive into the top working capital loans in Singapore, it’s important to understand the types of business financing commonly available to SMEs and entrepreneurs. Working capital loans are just one category within a broader financing ecosystem. Below are some of the main business loan options that can help support operations, growth and cash flow management.

1. Standard Business Loan

A standard business loan remains one of the most common financing solutions provided by banks in Singapore. These loans are generally unsecured, meaning businesses are not required to pledge assets, property or vehicles as collateral. Loan amounts and repayment periods differ among lenders, but terms often extend up to five years, depending on a company’s credit profile and financial standing.

This type of financing is versatile and can be used for multiple business needs such as purchasing inventory, modernizing equipment or covering short‑term working capital requirements. Since such loans pose relatively higher risk to lenders, interest rates are typically adjusted based on the applicant’s financial health, cash‑flow stability and credit history.

A standard business loan is particularly suitable for enterprises with consistent revenue streams and a proven track record of operations. It helps maintain liquidity without diluting ownership, offering a reliable means to support ongoing business growth and financial sustainability.

2. SME Working Capital Loan (WCL)

Backed by the Singapore government under the Enterprise Financing Scheme (EFS), the SME Working Capital Loan is tailored specifically to help local small and medium-sized enterprises access affordable funds. This initiative is especially helpful for supporting day-to-day operations and cash flow.

Businesses can borrow up to S$1 million, with repayment terms ranging from 1 to 5 years. One key eligibility requirement is that at least 30% of the company must be locally owned (by Singapore Citizens or Permanent Residents). The government partially shares the risk with the participating financial institutions, allowing for more favourable interest rates compared to standard commercial loans. This makes it one of the most accessible and practical options for SME financing in Singapore today.

3. Temporary Bridging Loan Programme (TBLP)

The Temporary Bridging Loan Programme was introduced as a COVID-19 support measure, but it has since been extended to assist businesses navigating post-pandemic recovery and uncertain economic conditions. The TBLP allows businesses to access up to S$5 million in funding, with repayment periods of up to 5 years.

Like the WCL, the TBLP requires a minimum of 30% local ownership and it is open to all industries. The government co-shares the default risk, which makes the interest rates lower than many typical unsecured loans. Many SMEs use this facility to shore up cash reserves, invest in digitalisation or enter new markets. It’s a versatile financing option for companies needing a buffer to weather transitional periods.

4. Startup Business Loan

New businesses that lack a financial track record may find it challenging to secure traditional bank loans. Startup business loans are designed to bridge this gap by offering funding solutions based on projected performance rather than historical profits.

Typically, loan amounts are capped at around S$100,000 and while these loans are also unsecured, the lender may request business plans, cash flow forecasts or personal income statements from the founders. This loan type is suitable for early-stage startups, home-based ventures or retail businesses needing initial working capital for setup, marketing and operations. Though slightly higher in risk, they offer a critical opportunity to get your business off the ground.

5. Business Loans from Licensed Moneylenders

For businesses that require fast access to working capital or cannot meet the strict loan criteria set by major banks, licensed moneylenders in Singapore provide a legitimate and effective financing alternative. These lenders operate under the supervision of the Ministry of Law (MinLaw), which enforces regulations on interest rates, repayment conditions and disclosure standards to ensure fair lending practices.

The application process is typically streamlined, with approvals often finalized within just a few days. Eligibility requirements are more flexible compared to traditional banks, making this option particularly suitable for SMEs with limited credit history or for companies that need an immediate cash injection to manage cash‑flow shortfalls or cover urgent business expenses.

Although interest rates and administrative fees may be higher than those offered by financial institutions, borrowers benefit from speed, convenience and simplified documentation. To make informed decisions, it is essential to compare offers carefully and borrow only what is necessary. Partnering exclusively with MinLaw‑approved moneylenders helps businesses maintain financial transparency, regulatory compliance and long‑term credit sustainability.

Top 5 Working Capital Loans in Singapore

1. DBS Working Capital Loan

DBS Bank provides a comprehensive working capital loan designed for small and medium‑sized enterprises (SMEs) seeking to strengthen cash flow, fund business expansion or sustain day‑to‑day operations. With a competitive annual interest rate of about 7.75%, DBS maintains transparent loan terms that help entrepreneurs make confident, well‑informed financial decisions.

DBS Working Capital Loan

The loan carries no annual maintenance fee and includes only a modest 1.5% processing charge, making it a cost‑efficient option over its repayment period. Monthly instalments average around S$3,023.54, well‑suited for businesses with steady revenue patterns. One of DBS’s main advantages is its digitally streamlined application system that integrates smoothly with its online banking ecosystem, minimizing paperwork and ensuring faster loan disbursement.

The DBS Working Capital Loan is unsecured, so borrowers are not required to pledge real estate or other assets as collateral. This accessibility appeals to new or expanding companies that may not yet hold high‑value business assets. Additionally, DBS supports applicants through personalized advisory services and repayment assessment tools, reinforcing responsible borrowing practices rooted in risk‑managed financing.

As Singapore’s leading SME bank, DBS draws on its deep understanding of local business environments and sector‑specific challenges. Its loan offering caters to a wide variety of industries including logistics, e‑commerce, food and beverage (F&B) and professional services. For enterprises seeking a scalable financing solution from a trusted, digitally advanced bank, the DBS Working Capital Loan stands out as a strategic choice for sustainable business growth.

2. OCBC Working Capital Loan

OCBC’s working capital loan is designed for small and medium enterprises needing accessible funds to meet operational demands, payroll obligations or vendor payments. With an annual interest rate of 7.75%, OCBC offers parity with DBS in terms of affordability and their processing fee is similarly fixed at 1.5%. Monthly repayments amount to S$3,023.54, allowing SMEs to forecast financial commitments clearly.

OCBC Working Capital Loan

What sets OCBC apart is its customer-centric SME support framework. The bank provides a dedicated relationship manager and digital tools that help business owners monitor loan performance, plan cash flow and manage finances through an intuitive dashboard. OCBC’s no-annual-fee policy enhances cost efficiency over the loan’s duration.

OCBC requires no collateral for this loan product, making it viable for startups and lean businesses. In addition, the bank’s streamlined approval process allows faster disbursement, a critical feature when managing working capital shortfalls or pursuing time-sensitive opportunities.

OCBC is one of Singapore’s oldest banks with a deep SME portfolio, giving it rich industry insight. Its working capital loan aligns with both conservative and high-growth SMEs seeking flexible financing without overextending their obligations. For businesses prioritizing relationship banking and consistent support, OCBC is a trusted name.

3. CIMB Working Capital Loan

CIMB Bank provides one of the most cost‑effective working capital loan solutions available among Singapore’s major financial institutions. With an attractive annual interest rate of around 6.5%, the bank offers affordable financing tailored for SMEs aiming to manage cash‑flow needs, pursue business expansion or resolve short‑term liquidity requirements. The lower rate translates to reduced borrowing costs, reflected in an estimated monthly repayment of about S$2,934.92, which is more competitive than typical offers from DBS or OCBC.

CIMB Working Capital Loan

Processing fees range between 1% and 2%, depending on the borrower’s credit profile and loan structure, while no annual fees are charged. This arrangement keeps the total cost of credit low and adds financial predictability for businesses managing tight budgets. The loan is particularly well‑suited for small enterprises in need of quick funding or those navigating temporary cash‑flow issues.

CIMB stands out for its responsiveness and willingness to support younger businesses that may not meet the stringent criteria imposed by traditional lenders. The bank maintains a simple documentation process and provides a user‑friendly online portal for application management and repayment tracking. This digital accessibility, combined with competitive pricing, makes CIMB an appealing choice for entrepreneurs seeking flexible yet affordable financing.

Moreover, CIMB’s strong presence in cross‑border banking across Malaysia, Singapore and the wider Southeast Asia region gives SMEs with regional operations an added advantage. Its business‑friendly policies, integrated ASEAN network and customizable loan terms make the CIMB Working Capital Loan an ideal option for SMEs that value both cost efficiency and scalable financial support.

4. RHB Working Capital Loan

RHB Bank provides a practical working capital loan solution with a moderate annual interest rate of 7%, making it slightly more affordable than DBS or OCBC. Monthly repayments are structured at S$2,970.18, offering predictability in managing cash flow.

RHB Working Capital Loan

With a processing fee ranging from 1% to 2%, RHB provides some flexibility based on loan size and risk assessment. Like other major banks, it does not charge any annual fee, enhancing the affordability of the loan over time.

RHB stands out for its hands-on approach to SME lending. It actively supports small business owners with personalized loan consultations and structured repayment plans, which is beneficial for businesses navigating uncertain economic periods. The bank also provides digital channels for loan tracking, reducing the time spent on administration.

SMEs in construction, retail and service sectors may find RHB’s loan options particularly appealing due to the bank’s practical understanding of industry challenges. Its working capital loan serves as a reliable financial bridge during revenue gaps or inventory procurement periods.

For businesses looking for predictable financing, supported by customer-oriented service and lower repayment pressure, RHB is a compelling contender.

5. Standard Chartered (SCB) Working Capital Loan

Standard Chartered Bank (SCB) offers a working capital loan with a well‑structured financing plan suited for small and medium‑sized enterprises (SMEs). Featuring a 7% annual interest rate, monthly repayments of around S$2,970.18 and a modest processing fee of 1% to 2%, this loan remains both competitive and predictable. Like other major banks in Singapore, SCB waives annual maintenance fees, helping businesses manage total borrowing costs more effectively.

Standard Chartered (SCB) Working Capital Loan

The bank places strong emphasis on digital‑first banking, giving SMEs access to paperless loan applications, real‑time disbursement tracking and online customer support. This integrated digital infrastructure enhances convenience and speed, which are crucial for managing day‑to‑day working capital needs in fast‑moving industries.

SCB’s loan is unsecured, enabling companies to obtain financing without pledging physical collateral. What differentiates SCB is its holistic credit assessment model, which evaluates business growth potential and cash‑flow stability in addition to credit history. This inclusive approach is particularly beneficial for younger businesses or those rebuilding after the pandemic, making access to credit more attainable.

With a global presence spanning key business hubs, SCB supports internationally focused SMEs that require scalable and flexible financing solutions. The bank also provides cross‑border banking tools and foreign exchange (FX) services that complement its working capital facilities, facilitating smoother operations for companies engaged in regional or international trade.

For enterprises that value both financial stability and innovation, Standard Chartered Bank delivers a comprehensive loan package that balances traditional reliability with forward‑thinking digital efficiency.

Alternative Lending Options: Exploring P2P Lending in Singapore

As traditional banks maintain strict lending criteria, Peer-to-Peer (P2P) lending platforms have emerged as flexible alternatives for SMEs in Singapore seeking working capital. These digital-first platforms connect businesses directly with investors, often offering quicker disbursement, relaxed eligibility criteria and competitive rates. Two prominent players in this space are Validus and Funding Societies.

6. Validus P2P Lending

Validus is one of Singapore’s leading P2P financing platforms, regulated by the Monetary Authority of Singapore (MAS). It offers unsecured working capital loans tailored to SMEs, with an annual interest rate as low as 1.3%, significantly lower than many traditional lenders.

With a monthly repayment of $2,583.48, businesses can maintain steady cash flow while addressing short-term capital needs. The processing fee ranges from 2.5% to 5%, with no annual fee, making it a transparent and cost-efficient option for businesses looking to bridge cash gaps or expand operations.

Validus P2P Lending

Validus also integrates alternative data, including digital transactions and invoicing history, into their credit assessment. This makes it particularly suitable for startups and SMEs with thin credit files. The digital application process is streamlined, with approvals typically granted within 48 hours, providing fast access to funds with minimal paperwork.

For SMEs prioritizing speed, flexibility and lower interest costs, Validus is a compelling alternative to bank loans.

7. Funding Societies P2P Lending

Funding Societies is a Monetary Authority of Singapore (MAS)‑licensed peer‑to‑peer (P2P) lending platform that supports small and medium‑sized enterprises (SMEs) across Southeast Asia. Its working capital loan comes with a competitive annual interest rate of about 1.65%, no annual fees and an estimated monthly repayment of S$2,606.26. Processing fees range between 3% and 8%, depending on the loan amount and business risk profile.

Funding Societies P2P Lending

A defining feature of Funding Societies is its technology‑driven underwriting system, which uses machine learning algorithms and real‑time financial data to evaluate applications efficiently and fairly. This enables the platform to extend financing even to SMEs with limited credit histories. The process is entirely digital, from application to fund disbursement, allowing businesses to access financing within 24 to 72 hours – a solution ideal for enterprises in need of fast, dependable capital.

The platform also provides flexible repayment options and a transparent fee framework, helping SMEs manage budgets confidently and avoid unexpected charges. Whether a business is addressing a temporary cash‑flow gap or seeking funds for growth and expansion, Funding Societies offers a modern, data‑driven financing solution tailored to the unique stages of a company’s development.

Latest Working Capital Loan Rates

Below find all current working capital loan rates available in the Singapore market. The rates shown reflect current market conditions and are subject to individual credit assessments and prevailing economic factors. Businesses seeking working capital financing can use this information to compare available options and identify the most suitable loan products for their operational needs

Consideration

When assessing working capital loan options in Singapore, it is essential to look beyond interest rates alone. Elements such as loan tenure, early repayment conditions, eligibility criteria and approval speed play a crucial role in shaping your business’s cash‑flow management. While traditional institutions like DBS, OCBC and CIMB offer structured repayment plans with competitive rates, their credit evaluation processes can be stringent and often require a strong credit history supported by solid financial statements.

For younger SMEs or companies with seasonal revenue cycles, flexibility may hold greater importance than cost. In such cases, exploring options from RHB Bank, Standard Chartered Bank (SCB) or licensed financial institutions could prove advantageous. It is equally important to review all processing fees and ancillary charges, as these can accumulate over time and influence your total borrowing cost.

Businesses should also evaluate their short‑term liquidity, cash‑flow forecasts and repayment capacity before finalizing a loan. Even when interest rates appear attractive, taking on excessive debt may create financial strain if revenue performance falls short of projections. Developing a comprehensive cash‑flow plan, supported by expert guidance from financial comparison platforms such as Roshi.sg, can help identify a financing structure that aligns with your operational strategy and long‑term growth objectives.