Is a Fast Cash Loan Right for You?

Fast cash loans can help with certain financing needs but they shouldn't become a regular solution.

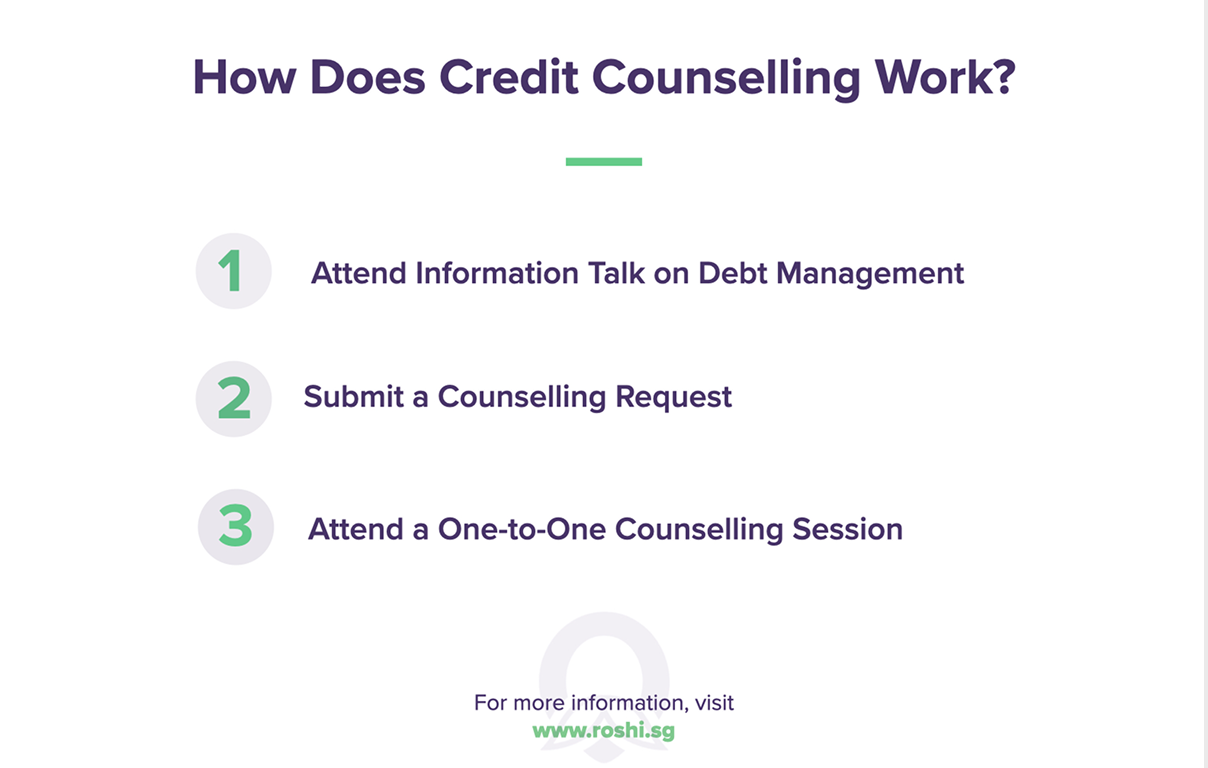

Before applying, consider your repayment plan and if you’re able to comfortably repay the loan. If you find yourself relying on loans frequently, it may be worth reviewing your overall budget or speaking with a financial advisor.

When you need funds quickly, licensed moneylenders offer a convenient alternative to traditional banks. Just be sure to compare rates and borrow only what you can confidently repay.

Tips For Faster Loan Approvals

Have your documents ready before applying

NRIC, latest payslip, bank statement, proof of address...

Apply during business hours (9am-5pm)

Applications submitted after hours may be processed next day...

Choose PayNow for fastest disbursement

PayNow is instant, Bank transfers can take 1-2 hours

Be honest on your application

Discrepancies slow down verification or might get you declined

Apply with licensed moneylenders or regulated banks only

Unlicensed lenders may have hidden fees and offer no regulatory protection.

Loan Type Comparisons

| Loan Type | Application Time | Approval | Disbursement |

|---|---|---|---|

| Bank Personal Loan | 15-30 min | 1-5 days | 1-3 days |

| Digital Bank Loan | 5-10 min | 1-2 hours | Same day |

| Licensed Moneylender Loan | 5-10 min | 30 min to 2 hr | Same day |

| Credit Card Advance | Instant | Instant | Instant |

Interest Rate Trends

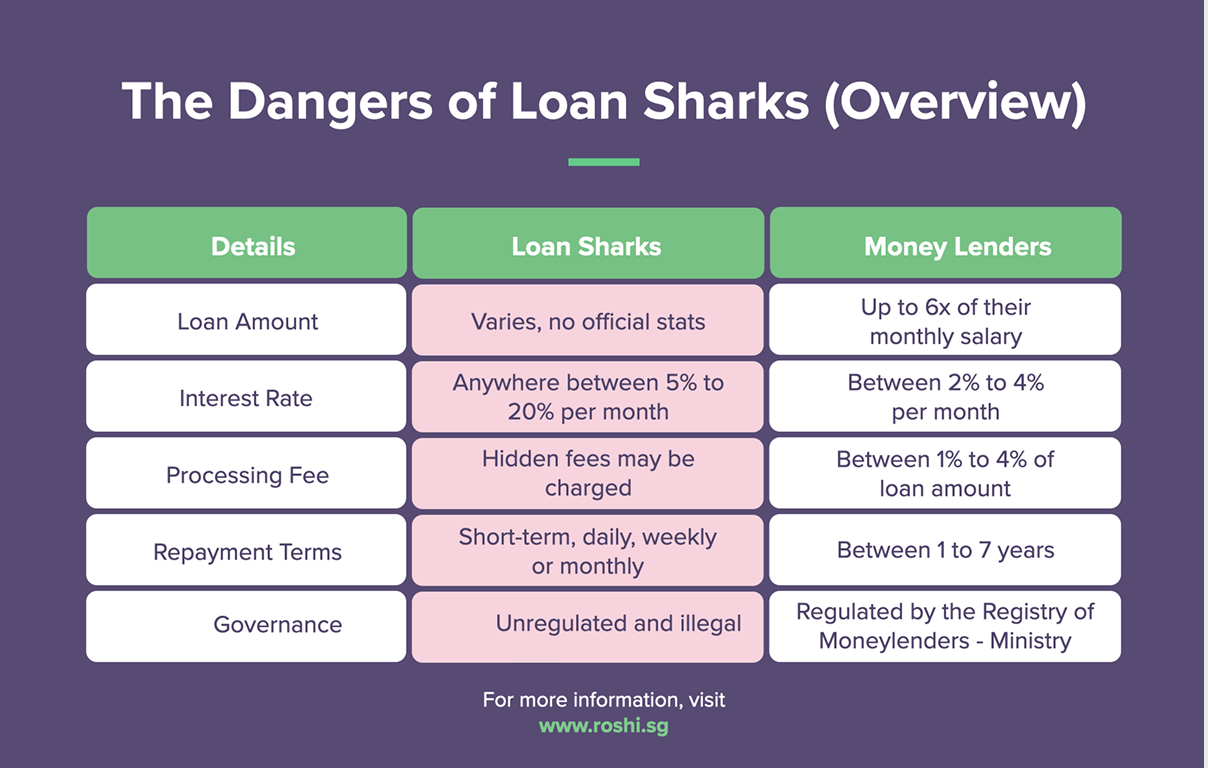

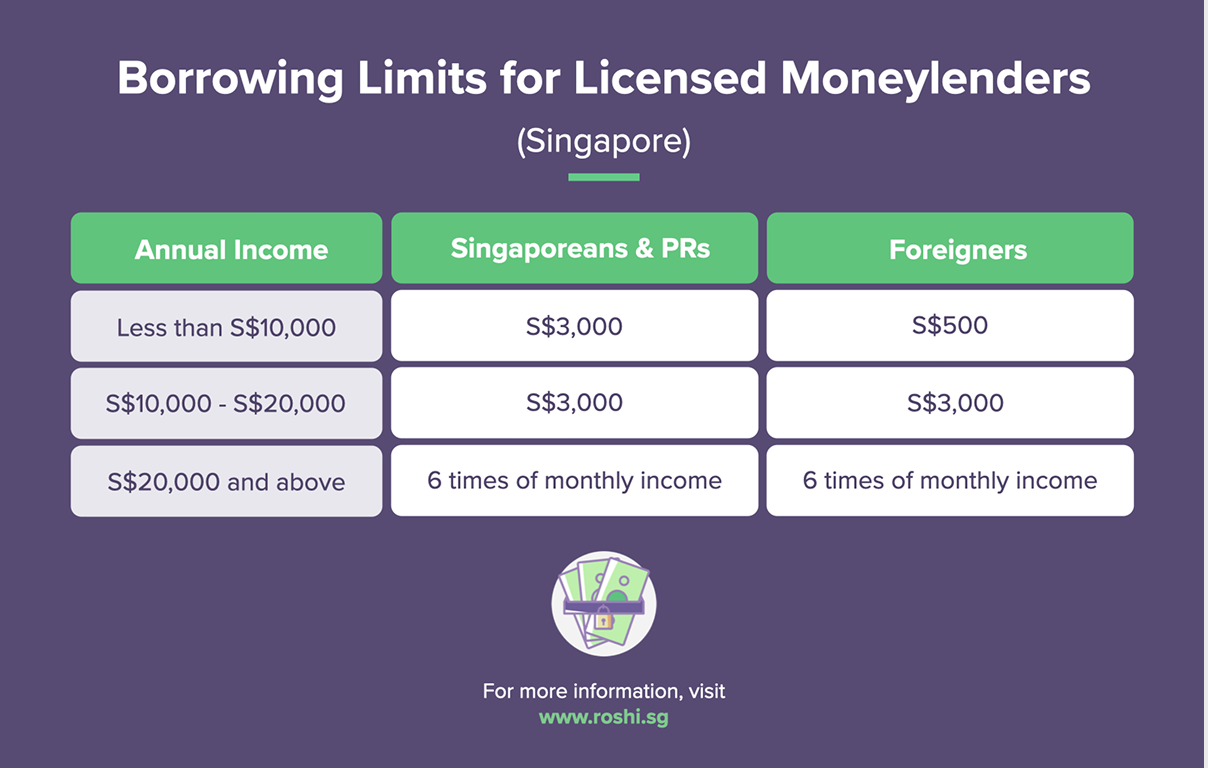

Borrowers are still allowed to take loans of up to six times their monthly salary, subject to regulatory limits. Administrative fees remain capped at 10% of the principal and late fees typically do not exceed S$60 per month. While many licensed moneylenders now offer convenient online applications, including Singpass-enabled verification, Ministry of Law regulations still require borrowers to complete at least one in‑store visit at a physical outlet before loan disbursement. With proper documentation in place, approvals can still be completed within the same day or even under one hour, making licensed moneylenders a key option for fast cash needs.

Promotional offers continue to influence borrower behaviour. For example, CIMB’s flash deals advertise rates from around 1.56% p.a., translating to EIRs of approximately 3%, subject to eligibility and campaign terms. Despite the cost advantages, these bank options typically involve stricter credit checks and approval timelines of several days, making them less suitable for urgent cash requirements compared to licensed moneylenders.

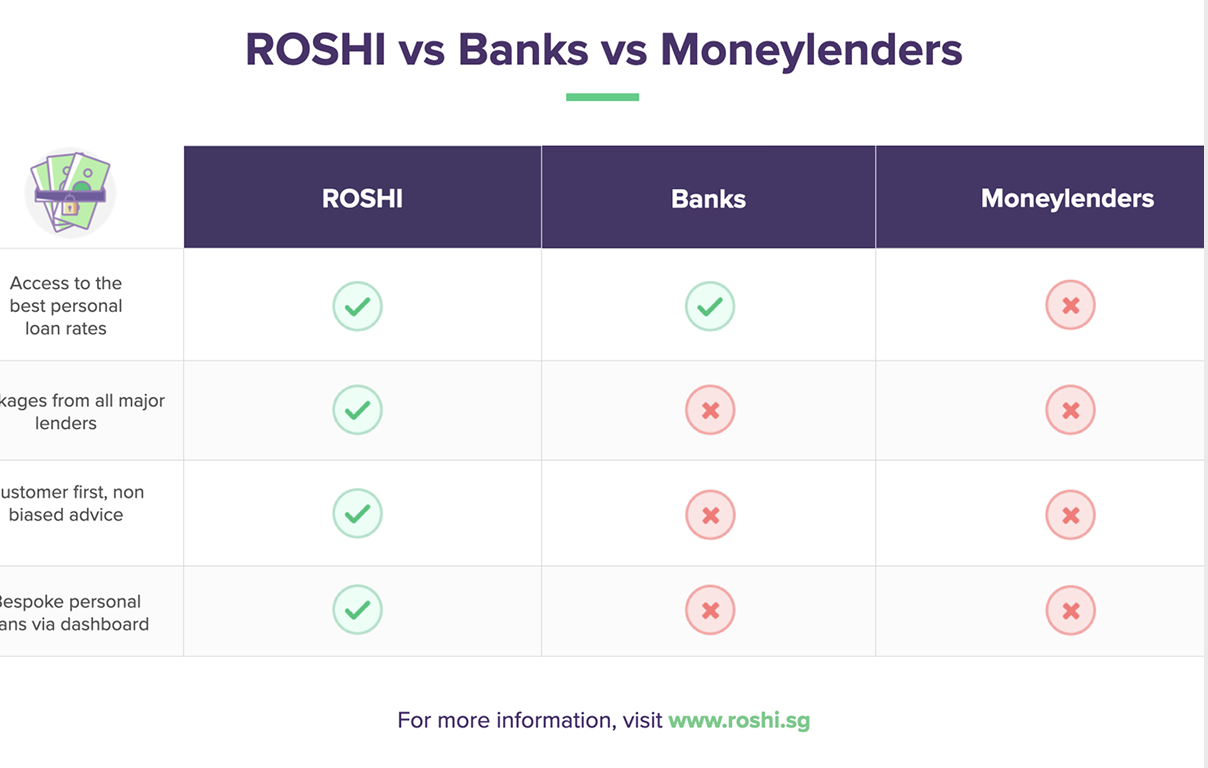

From ROSHI’s perspective, borrowers should align their choice with urgency and repayment comfort. For time-sensitive needs, ROSHI’s licensed lender network offers fast, regulated and transparent solutions. Where timing allows, exploring bank loan options can result in meaningful savings over the life of the loan.

Singapore’s regulatory safeguards continue to provide protection through clear interest caps, fee limits and transparent disclosures. Using reputable platforms like ROSHI helps borrowers navigate licensed moneylenders and bank alternatives with confidence, ensuring decisions are based on urgency, affordability and long-term financial impact.

![How to Improving Your Credit Score in Singapore? [Updated Information 2025]](https://www.roshi.sg/wp-content/themes/roshi/images/new-home-page/expert/e9.png)