Our Expert says

A low credit score doesn't define your financial future!

If your score dropped because of a rough patch, licensed moneylenders can still help. They assess your MLCB record, your current monthly income, your existing debt situation and your ability to make repayments.

Borrow what you can repay and use the loan to stabilise your financial situation at the same time avoid getting into recurring unmanageable debt.

Trinh Thanh

Head of Research

Get Approved with Bad Credit

How to Improve Your Approval Chances

- Show stable income with recent payslips or CPF statements

- Reduce existing debts before applying

- Borrow only an amount you can comfortably repay

- Bring complete documents to avoid approval delays

- Be honest about your financial situation, lenders check your MLCB report anyway

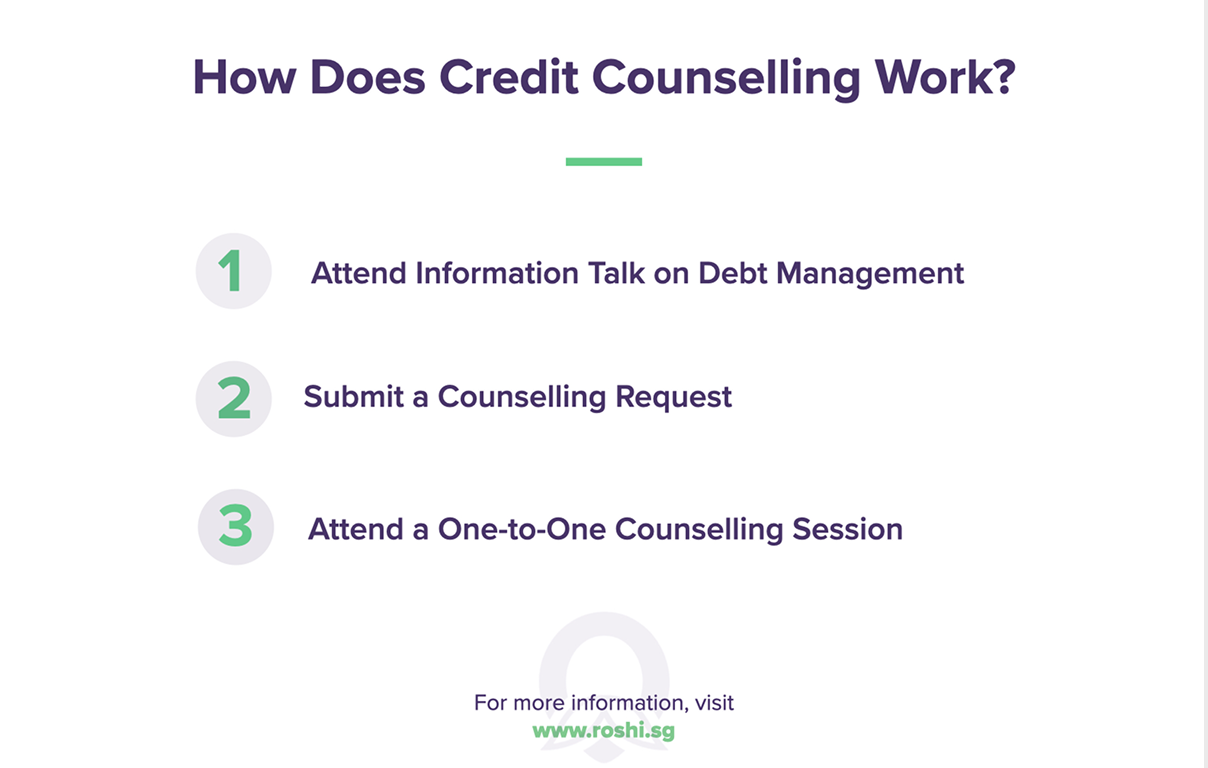

Where to Get Help

Rebuilding takes time but consistent effort pays off

- Pay all bills and loan on time, every month

- Keep credit card utilisation below 30% of your limit

- Avoid submitting multiple loan applications in a short period

- Check your CBS report regularly for errors

- Check your MLCB report to make sure your moneylender repayments are recorded correctly

- Set up auto payments wherever possible

- Close unused credit lines you no longer need

With consistent on-time payments most borrowers see improvement within 6–12 months.

Interest Rate Trends

Below is an overview of current interest rate trends in Singapore:

Today's moneylender interest rate trends in Singapore

Today's moneylender interest rate trends in Singapore - As of 15 February 2026, licensed moneylenders are charging an average interest rate of approximately

3.9% per month just under the legal cap of 4%.

Monthly Interest Rate Trends (February2026)

Research provided by Trinh Thanh on 12 February 2026 - In February 2026, Singapore’s bad credit loan segment continues to reflect a cautious but stable lending environment. Borrowers with weaker credit profiles remain active in the market, driven largely by short-term cash needs rather than long-term financing goals. Interest rate conditions remain unchanged, with regulatory caps continuing to shape pricing across the sector.

Unlike mainstream personal loans, bad credit loans are more sensitive to risk assessment than broader market movements. As a result, applied monthly rates remain relatively stable, while lenders place greater emphasis on affordability checks and repayment capacity. February shows no signs of tightening or loosening in policy, reinforcing a predictable environment for higher-risk borrowers.

Unlike mainstream personal loans, bad credit loans are more sensitive to risk assessment than broader market movements. As a result, applied monthly rates remain relatively stable, while lenders place greater emphasis on affordability checks and repayment capacity. February shows no signs of tightening or loosening in policy, reinforcing a predictable environment for higher-risk borrowers.

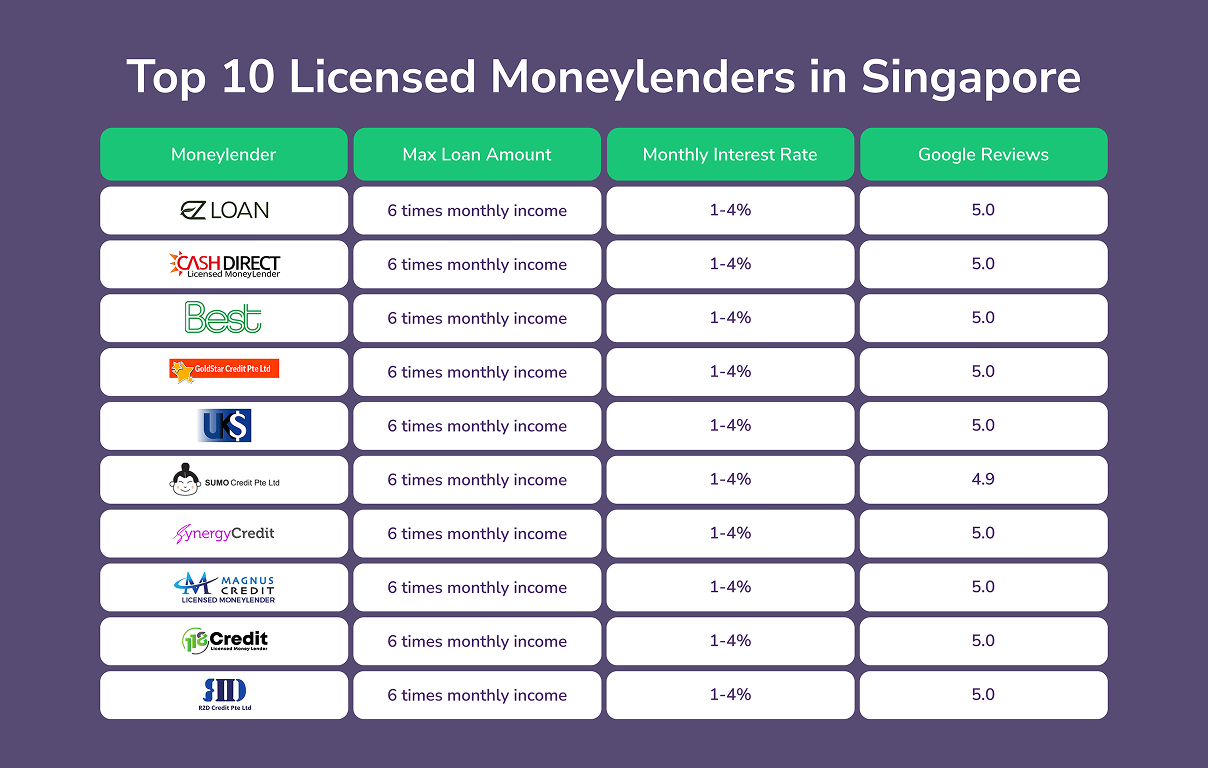

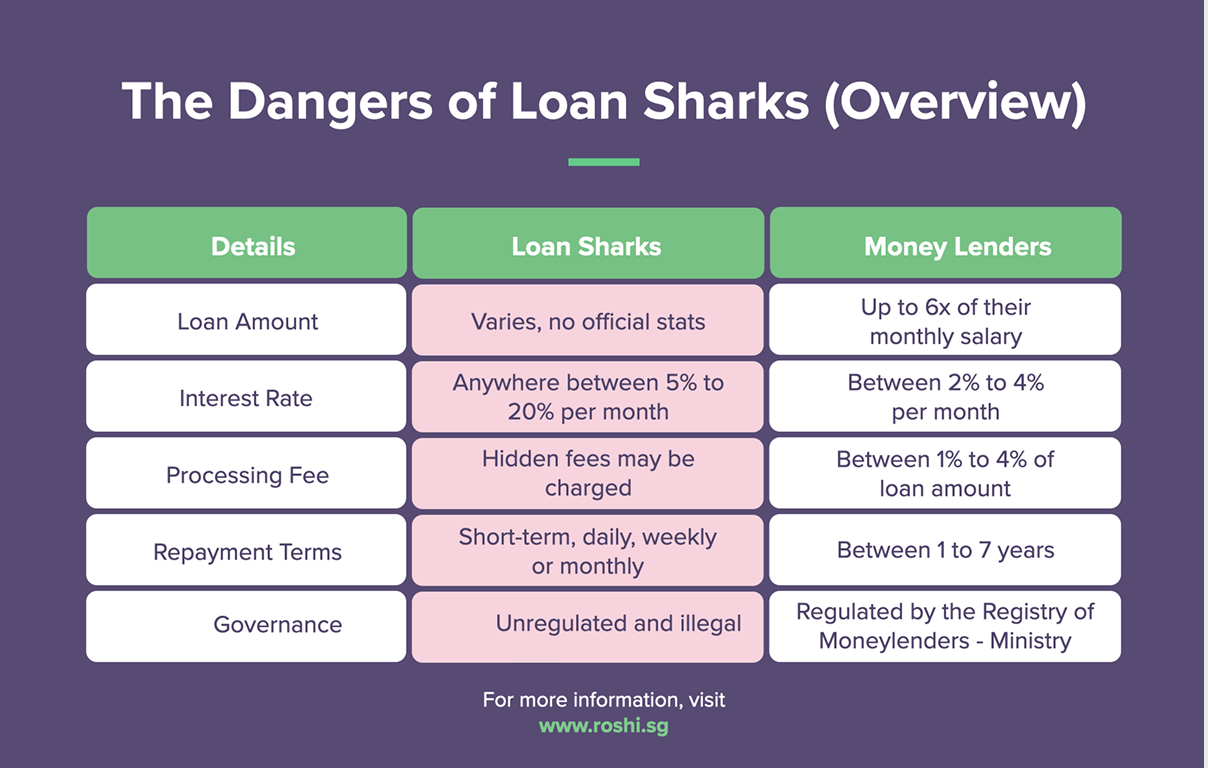

Licensed Moneylenders

Licensed moneylenders regulated by the Registry of Moneylenders under Singapore’s Ministry of Law remain the primary source of bad credit loans in February 2026. Average applied monthly interest rates continue to sit at approximately 3.8%, staying just below the legal maximum of 4% per month, reflecting the higher risk associated with borrowers who have limited or impaired credit histories.

While borrowers may still be eligible to borrow up to six times their monthly income, approval decisions are closely tied to current income stability rather than past credit performance alone. Administrative fees remain capped at 10% of the principal, with late fees typically limited to S$60 per month. Although applications for bad credit loans can be submitted remotely and assessed digitally, licensed moneylenders are required to complete borrower identification and contract formalities in person at a physical branch in line with Ministry of Law regulations. Despite this requirement, approvals remain relatively fast, keeping licensed moneylenders accessible for borrowers who are unable to secure bank financing.

While borrowers may still be eligible to borrow up to six times their monthly income, approval decisions are closely tied to current income stability rather than past credit performance alone. Administrative fees remain capped at 10% of the principal, with late fees typically limited to S$60 per month. Although applications for bad credit loans can be submitted remotely and assessed digitally, licensed moneylenders are required to complete borrower identification and contract formalities in person at a physical branch in line with Ministry of Law regulations. Despite this requirement, approvals remain relatively fast, keeping licensed moneylenders accessible for borrowers who are unable to secure bank financing.

Banks

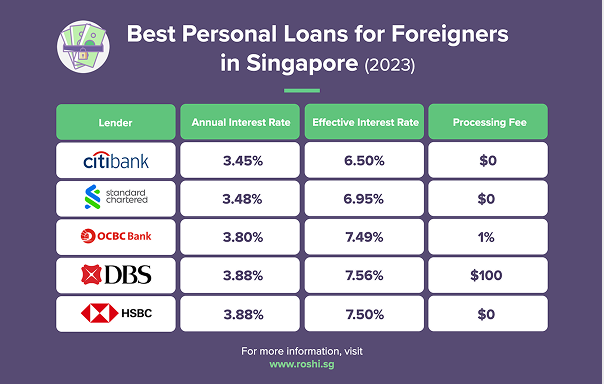

Banks in Singapore generally apply stricter credit assessment criteria, which limits access to bad credit loans. While banks offer lower Effective Interest Rates (EIR) on personal loans, these products are usually reserved for borrowers with stable credit histories and strong repayment profiles.

For individuals with poor or limited credit records, bank approval rates remain low and alternative arrangements such as secured credit or guarantor-backed loans may be required. As a result, banks play a limited role in the bad credit loan segment, particularly for borrowers seeking immediate or short-term funding.

For individuals with poor or limited credit records, bank approval rates remain low and alternative arrangements such as secured credit or guarantor-backed loans may be required. As a result, banks play a limited role in the bad credit loan segment, particularly for borrowers seeking immediate or short-term funding.

ROSHI Expert Insight

In February 2026, the bad credit loan market continues to highlight the importance of regulated access and transparency. Licensed moneylenders remain accessible to borrowers with weaker credit profiles, offering funding at monthly rates near 3.8%, provided affordability criteria are met. While these rates are higher than bank loans, they reflect the additional risk involved rather than arbitrary pricing.

From ROSHI’s perspective, bad credit loans should be viewed as a rebuilding tool rather than a long-term solution. Through ROSHI’s licensed lender network, borrowers can access regulated options that clearly outline repayment terms, helping them manage short-term needs while working towards improving their credit standing.

From ROSHI’s perspective, bad credit loans should be viewed as a rebuilding tool rather than a long-term solution. Through ROSHI’s licensed lender network, borrowers can access regulated options that clearly outline repayment terms, helping them manage short-term needs while working towards improving their credit standing.

What This Means for Borrowers

For borrowers in February 2026, bad credit loans remain available but require careful consideration. Licensed moneylenders continue to offer a regulated pathway for those unable to secure bank financing, though higher applied rates mean repayment planning is essential. Used responsibly, these loans can help address immediate needs without worsening financial strain.

Singapore’s consumer protection framework continues to safeguard borrowers through interest caps, fee limits and mandatory disclosures. By using reputable platforms like ROSHI, borrowers with poor credit can navigate available options confidently and make informed decisions that balance short-term relief with long-term financial stability.

Singapore’s consumer protection framework continues to safeguard borrowers through interest caps, fee limits and mandatory disclosures. By using reputable platforms like ROSHI, borrowers with poor credit can navigate available options confidently and make informed decisions that balance short-term relief with long-term financial stability.