Is a Fast Cash Loan Right for You?

Fast cash loans can help with certain financing needs but they shouldn't become a regular solution.

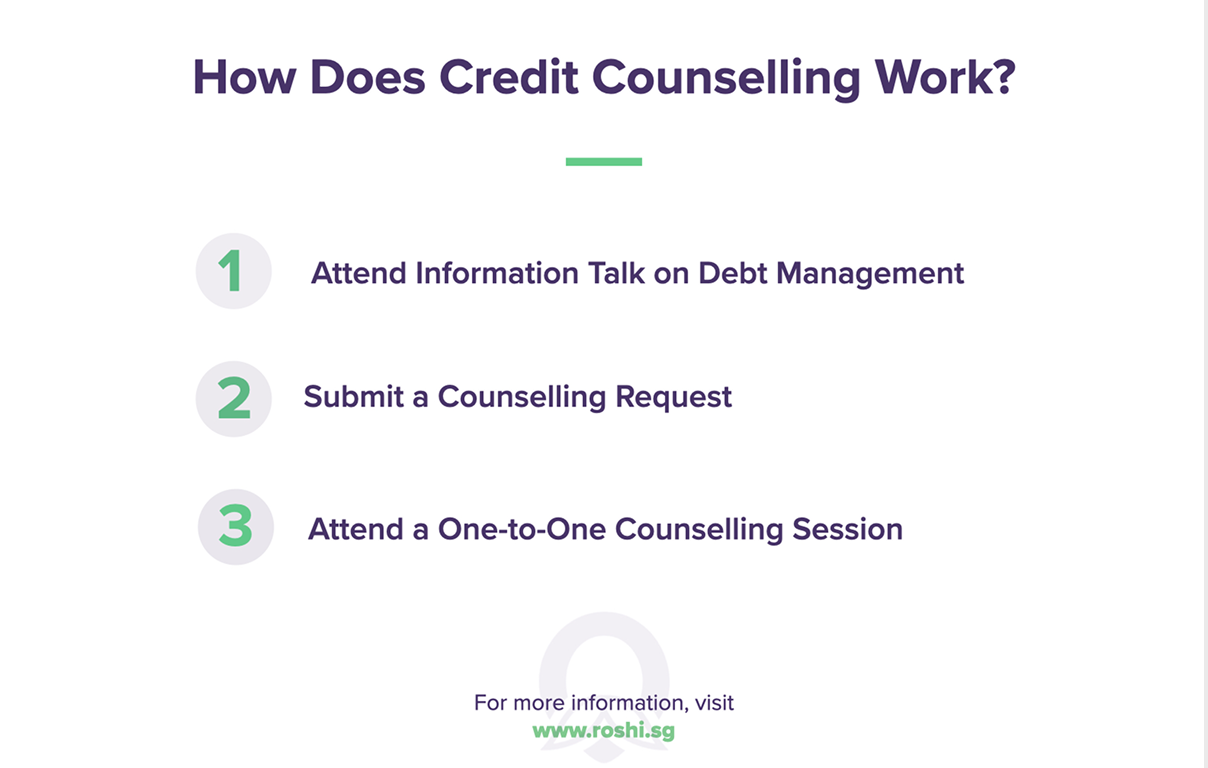

Before applying, consider your repayment plan and if you’re able to comfortably repay the loan. If you find yourself relying on loans frequently, it may be worth reviewing your overall budget or speaking with a financial advisor.

When you need funds quickly, licensed moneylenders offer a convenient alternative to traditional banks. Just be sure to compare rates and borrow only what you can confidently repay.

Tips For Faster Loan Approvals

Have your documents ready before applying

NRIC, latest payslip, bank statement, proof of address...

Apply during business hours (9am-5pm)

Applications submitted after hours may be processed next day...

Choose PayNow for fastest disbursement

PayNow is instant, Bank transfers can take 1-2 hours

Be honest on your application

Discrepancies slow down verification or might get you declined

Apply with licensed moneylenders or regulated banks only

Unlicensed lenders may have hidden fees and offer no regulatory protection.

Loan Type Comparisons

| Loan Type | Application Time | Approval | Disbursement |

|---|---|---|---|

| Bank Personal Loan | 15-30 min | 1-5 days | 1-3 days |

| Digital Bank Loan | 5-10 min | 1-2 hours | Same day |

| Licensed Moneylender Loan | 5-10 min | 30 min to 2 hr | Same day |

| Credit Card Advance | Instant | Instant | Instant |

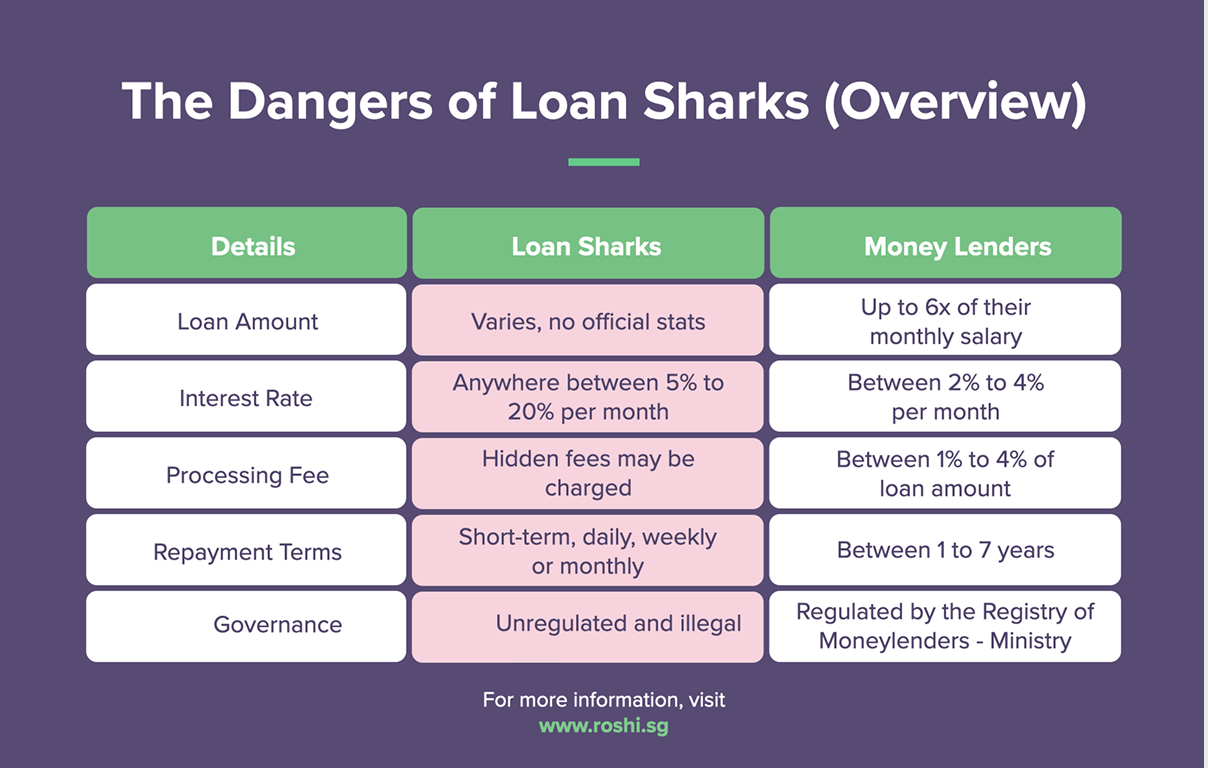

Interest Rate Trends

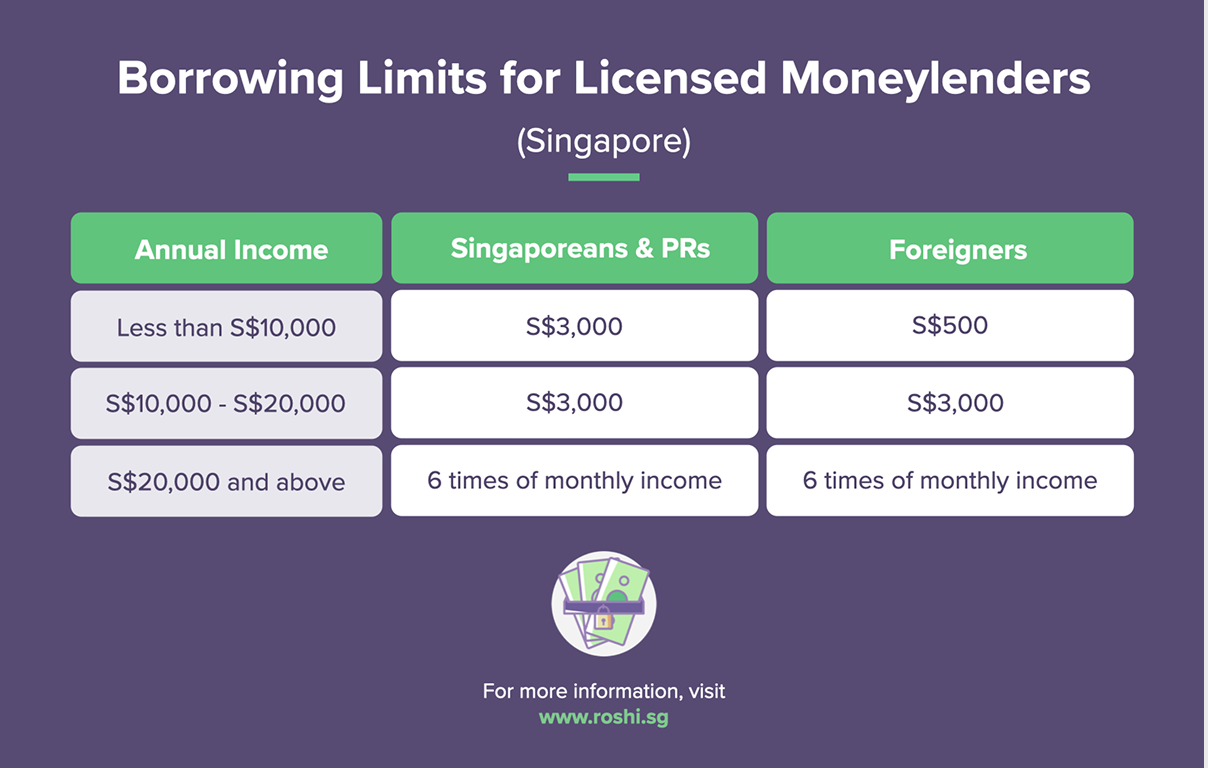

The highest monthly interest rate licensed money lenders which are regulated by the Registry of Moneylenders - Ministry is 4% per month. The maximum loan amount borrowers can take from licensed moneylenders is up to 6x of their monthly salary. Administrative fees remain capped at 10% of the principal and late fees typically do not exceed S$60 per month

Borrowers can still access emergency financing of up to 6× their monthly income with same-day or under-one-hour approval available when documentation is in order.

For example: CIMB’s flash deal offers rates from 1.56% p.a. (EIR from ~2.99%) until 9 September

These bank options, though more affordable on paper (especially with promotions) typically require more eligibility checks and unfold over several days less suited for immediate emergencies.

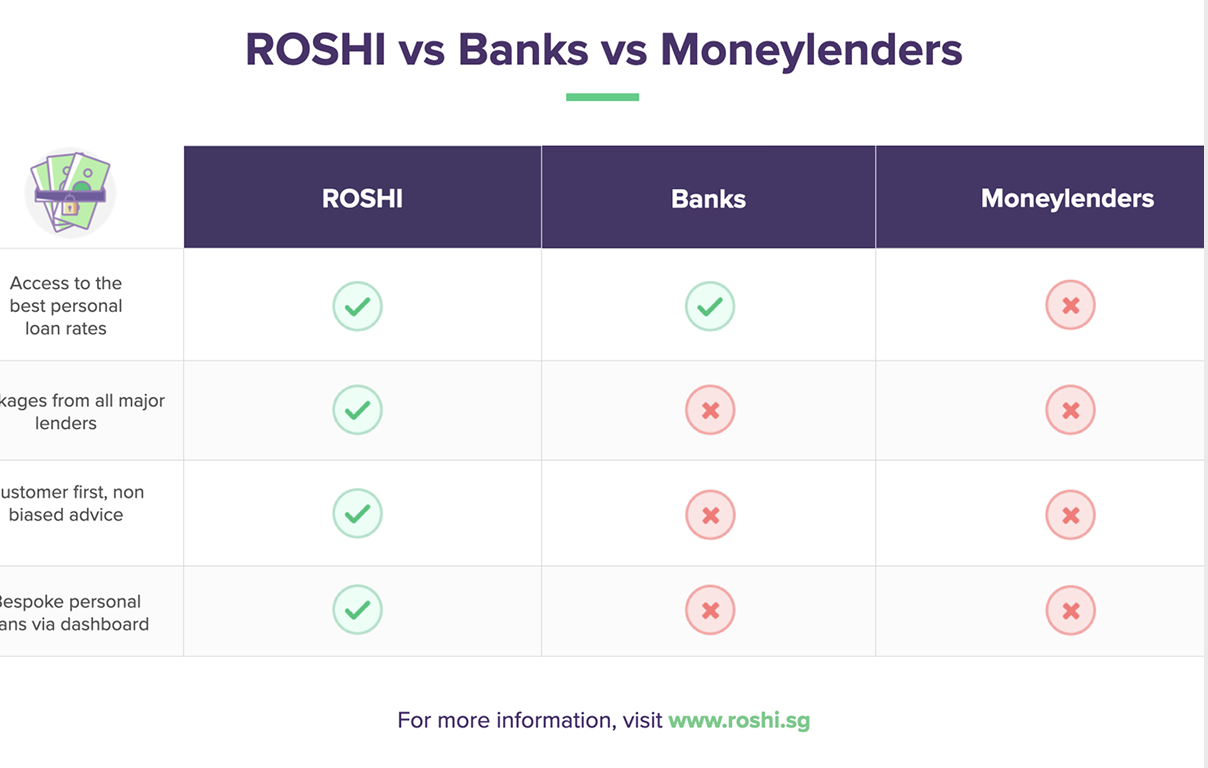

- Cost vs Convenience: For those who can afford minimal waiting, bank quick personal loans with EIRs around 3–4% p.a. (or lower with promotions) offer major savings over time.

- Strategic Borrowing: If situations allow, checking for ongoing bank promotions (e.g., CIMB or UOB) can reduce borrowing costs significantly.

- Regulated Safety: Legal caps and transparent EIR calculation help ensure borrowers aren’t unexpectedly burdened especially when using reputable, licensed platforms like ROSHI.

![How to Improving Your Credit Score in Singapore? [Updated Information 2025]](https://www.roshi.sg/wp-content/themes/roshi/images/new-home-page/expert/e9.png)